BANGKOK, THAILAND — Although rice production is holding steady, weather-related challenges are a constant worry for Thailand, which relies heavily on the crop as a food staple and export commodity.

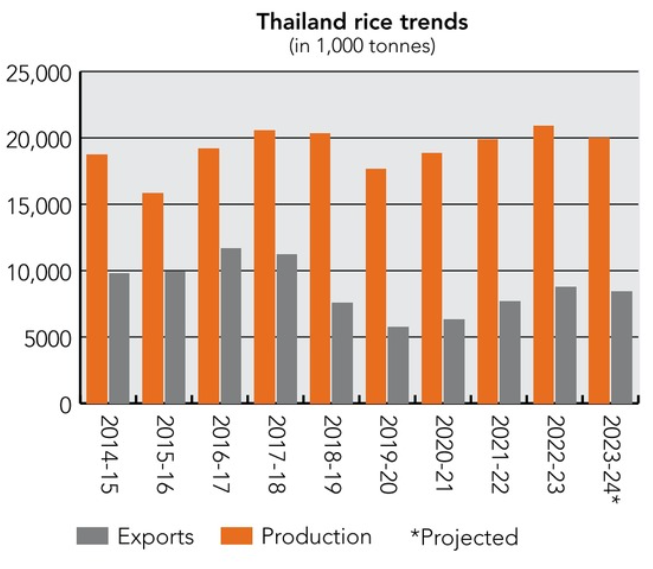

More than 60% of its agricultural land is allocated for rice farming, which is heavily dependent on water. Farmers typically grow rice twice a year during the wet and dry seasons. Production estimates for 2023-24 call for 19.9 million tonnes of rice, a 5% drop from 2022-23 due to reduced water availability during off-season production, according to the Foreign Agricultural Service (FAS) of the US Department of Agriculture.

Exports in 2022-23 are expected to increase 14% from the previous year to 8.8 million tonnes, largely due to India’s export restrictions, and drop slightly in 2023-24 to 8 million tonnes as exportable rice supplies increase in Vietnam and Cambodia.

All growing regions in Thailand are impacted by erratic weather patterns, in particular droughts and floods, that have increased in frequency and intensity, according to a report from The East-West Center.

“Precipitation, which was once predictable and consistent, has been more volatile and less common during the wet season,” the report said. “Floods and droughts are becoming more frequent, lasting longer, and are more intense and damaging.”

For example, in 2022 monsoon weather brought heavy rains and strong wind that resulted in flash floods, landslides and overflowing riverbanks in at least 25 provinces. But in 2023, rainfall was about 10% below average, and widespread drought is predicted for 2024, said The East-West Center.

Agriculture overall is an important sector in Thailand, employing about 30% of the labor force, according to the United Nations. However, it generated the lowest value added per worker and accounted for 8.81% of the gross domestic product in 2021.

In addition to climate change, the agriculture sector faces other challenges such as poverty, with 40% of farming households’ income below the poverty line; high debt levels; an aging workforce; small farm size; and lack of diversity in crops, with two-thirds of households growing one crop, the UN said.

Recovery in the hotel and foodservice sectors as tourism rebounds following the COVID-19 pandemic is expected to boost demand for feed and feed ingredients, the FAS said. Foreign tourists totaled 25 million in 2023 and is projected to reach 31.5 million in 2024, according to the Tourism Authority of Thailand. Economic recovery is continuing with 1.8% economic growth in 2023 and a projected 4.4% in 2024.

Crop production, exports

With a reduced water supply in off-season rice planting, the FAS lowered its original estimates for rice production in 2023-24 to 19.9 million tonnes. That’s a 5% decline from the estimated production of 20.9 million tonnes in 2022-23. Cumulative rainfall during the rainy season was 18% below normal and water reservoirs in the northern region and central plains had 20% less water compared to last year.

A combination of dry spells and floods damaged 2% of the main crop acreage, the FAS said. Drought and floods reduce the quantity and quality of rice grains by changing their moisture level and dimensions, and increasing the harvest of immature and cracked grains, according to The East-West Center report. Input costs also increase as do the incidences of crop failure, resulting in lower farmers’ earnings.

Once the largest exporter of rice, Thailand saw its exports fall 37% from 2011 to 2012, dropping to the lowest level since 2000. The decline was blamed on the government’s rice-buying scheme that pledged to buy rice above market prices. The government struggled to sell its rice and stockpiles began accumulating.

Exports have not fully recovered although Thailand consistently has been the second or third largest exporter of rice in the world. Total rice exports in 2022-23 are estimated at 8.8 million tonnes, while 2023-24 totals are estimated down at 8 million tonnes, which is still 4% above the five-year average.

Strong supply and competitive prices boosted demand for Thai rice from January-November 2023, the FAS said. Prices were $50 to $87 per tonne below Vietnamese prices. White rice exports, which account for 63% of the total, increased by 26% compared to the same period in 2022.

Fragrant rice exports increased 8% with top export destinations being the United States, Hong Kong and China.

“Nonetheless, Thai rice exporters express concerns about the exchange rate volatility and protracted geopolitical conflicts, which impact the trading environment and economics of trading partners,” the FAS said.

Corn production in 2023-24 is estimated at 5.4 million tonnes, a 1% increase from 2022-23 due to an acreage expansion of off-season corn due to attractive farm-gate prices, the FAS said. Prices from January to December 2023 were up 4% from the same period last year and well above the five-year average.

Imported corn demand was strong in the first five months of the year due to increased imports of duty-free corn from Burma. Tighter supplies are expected as border trade between Burma and China resumed as well as the ongoing unrest in Burma, the FAS said.

Soybean imports rebounded in 2022-23 to 3.9 million tonnes and are expected to increase slightly to 4 million tonnes in 2023-24, mainly due to strong demand in poultry and swine feed. Demand for soybeans in the food industry also is expected to grow.

Wheat production is marginal in Thailand because of the climate conditions, lack of seed development and unattractive prices. Wheat imports for 2023-24 are estimated at 3 million tonnes, a drop of 5% from 2022-23 but in line with the five-year average.

Wheat imports in the first five months of 2023-24 were up 92% due to the increase in feed wheat and milling wheat import demand, the FAS said. Livestock production is recovering, and feed wheat prices were more competitive than other imported feed grains.

“Industry sources reported that feed mills shifted to feed wheat for poultry and swine feed rations in response to high corn prices, following tight global corn supplies,” the FAS said.

Flour consumption

Milling wheat imports in the first five months of 2023-24 increased 29% to 502,000 tonnes, as the tourism sector continues its recovery. Total milling wheat imports for 2023-24 are estimated at 1.3 million tonnes, an increase of 18%. Imports of wheat flour and products also increased to 106,000 tonnes in the first five months of the year.

Flour mills are continuing to purchase wheat despite high import prices, the FAS said. Wheat consumption in 2023-24 is estimated at 2.5 million tonnes, an increase of 9% from last year. Milling wheat consumption accounts for 48% of that total at 1.3 million tonnes.

Instant noodles account for 35% of total milling wheat demand while bakery products account for 25%.

“Thailand’s reopening for foreign tourists has fueled the growing demand for milling wheat for baking and food processing,” the FAS said.

Thai millers and bakers are considered some of the most sophisticated and quality sensitive in southeast Asia, according to the Washington Grain Commission. It imports mostly from the United States for its bakery and biscuit segments and predominantly uses Australian wheat for its noodle flour.

Per capita consumption is estimated at about 42 pounds and has seen steady growth for the past 30 years, the commission said. Average consumption by product area is 35% noodles, 25% bread and Western-style products, 16% biscuits and 9% confectionery products.

As of 2018, Thailand had 12 wheat milling companies with daily production capacity of between 250 and 1,500 tonnes. Major flour producers in Thailand include United Flour Mill, Nisshin, Siam Flour Trading Co. Ltd., Thai Flour Mill Industry Co., Bangkok Flour, King Huat Group, and Kerry Flour Mills Ltd.