The Republic of Korea (South Korea) is a small-scale producer of grains, except for rice, leaving it highly dependent on imports for food as well as animal feed.

In its Grain Market Report from the end of February, the International Grains Council (IGC) puts South Korea’s total grains imports in 2019-20 at 15.5 million tonnes, unchanged from the previous estimate and up from 13.7 million in 2018-19. Maize imports for 2019-20 are forecast at 11.3 million tonnes, unchanged from last month, with 2018-19 imports at 9.8 million tonnes.

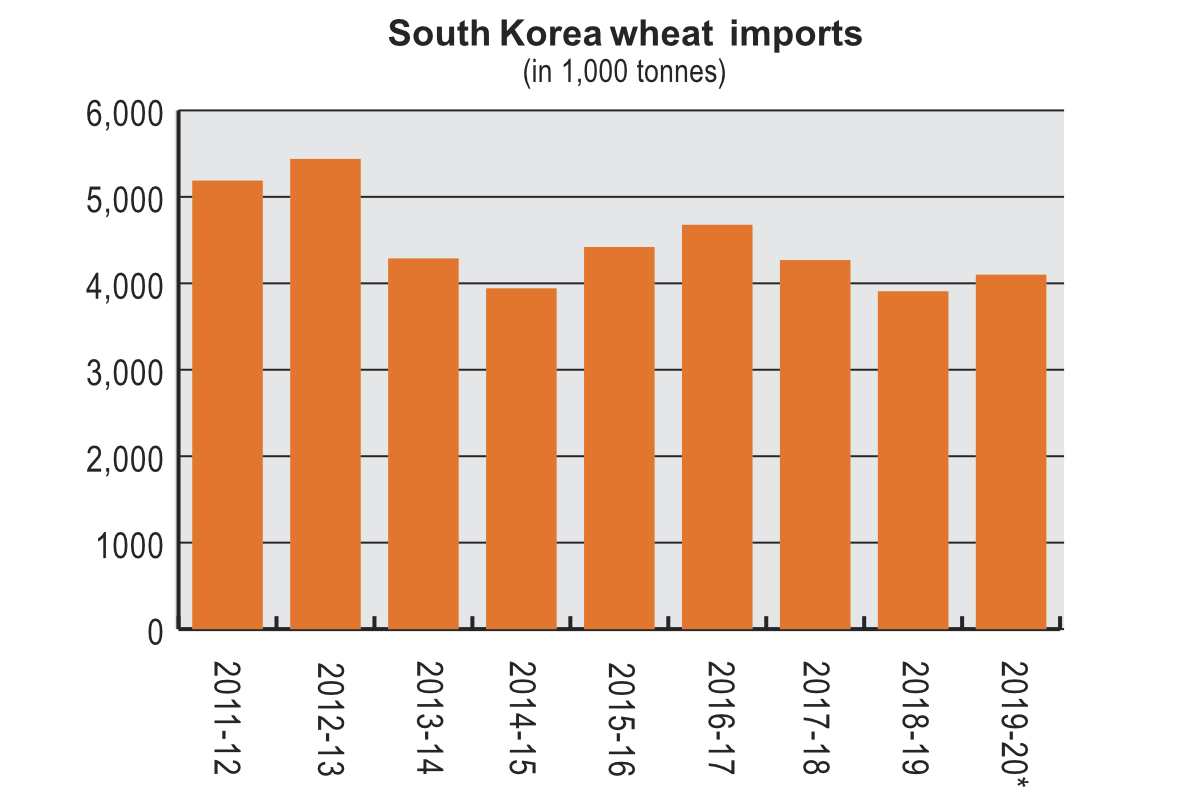

The total includes 4.1 million tonnes of wheat, also an unchanged forecast, up from 3.9 million the year before.

The IGC also expects South Korea to import 600,000 tonnes of rice in 2019-20, up from an estimate made a month earlier of 400,000 and also up on imports of 300,000 in 2018-19.

South Korea’s soybean imports are put at 1.5 million tonnes in 2019-20, unchanged from the earlier forecast, with the previous year’s imports at 1.4 million.

In an Oct. 30, 2019, update, the USDA attaché said official government data released at the end of June put wheat production in 2018 at 25,788 tonnes, based on a yield of 3.91 tonnes a hectare, down by about 3% from the year before because of frequent rain during the growing season. The government said at the end of July that the wheat area for the 2019 crop was 3,736 hectares, triggering a 46% cut in the USDA’s estimate of the South Korean crop to 13,000 tonnes.

“The projected decrease in production is due to the lack of demand for locally produced wheat, leading farmers to plant less wheat as they double crop in rice paddy areas,” the attaché said, explaining that official production data will not be available until June 2020.

For maize, the attaché gave a 2018 crop figure of 78,012 tonnes based on Korean government figures released at the end of June 2019, a rise of 7% from the previous year on improved yield.

The USDA in Seoul forecast 2019-20 maize consumption at 10.8 million tonnes, with 8.4 million for feed and 2.4 million for food, seed and industrial uses. Feed maize accounts for 42% of the total ingredients used for compound feed, with feed wheat at 6%.

“Food, seed, and industrial (FSI) corn consumption is expected to stay around 2.4 million tonnes to meet stable demand for high-fructose corn syrup (HFCS) and other corn products from Korean food industries,” the attaché said.

Total compound feed production is forecast to reach a record 20.5 million tonnes in 2019-20, according to the attaché.

“This record volume is based on strong growth in poultry and beef cattle inventories, which will partly offset the anticipated reduction in swine inventories affected by the Sept. 17, 2019, outbreak of African swine fever (ASF),” the attaché said. “Poultry and beef cattle numbers are expected to be strong as they may replace the reduction of pork production and consumption.”

Outside animal feed, the attaché said “corn processors use Genetically Engineered (GE) corn, non-biotech Identity Preserved (IP) corn, and conventional corn to produce corn starch, HFCS and corn flour.”

“Perceived public concern about biotech products continues to influence decisions regarding imported processing corn, especially corn that is used to manufacture cooking oil and HFCS,” the attaché said. “Many food processing companies have been reluctant to use ingredients sourced from biotech corn. Some food processing companies utilizing corn starch products are sourcing ingredients imported from China, since these items are reportedly derived from non-biotech corn.”

In an April 2, 2019, update, the attaché put South Korean production of barley at 151,403 tonnes in 2018, up 38% from the previous year, on the basis of a sharp increase in area, adding that production had fallen sharply in 2012, when a government purchasing program ended, but has rebounded since and is expected to remain constant.

Oilseeds

In a March 1, 2020, report on the oilseeds sector, the USDA attaché cited crop figures for 2018, from the farm minister and Statistics Korea (KOSTAT), of 80,804 tonnes for soybeans, 11,002 for peanuts, 25,129 for sesame and 37,377 for perilla. In 2019, soybean production rose to 105,340 tonnes, while sesame output was up slightly at 12,896 tonnes, while figures for the other crops will not be made available until May 2020.

“Soybeans are the most heavily consumed oilseed in Korea,” the attaché said, forecasting total domestic consumption in 2020-21 at around 1.39 million tonnes, unchanged from the previous year, “amid stagnant domestic production and flat consumer demand consistent with a mature market.”

The total is expected to include 1 million tonnes for crushing, 340,000 tonnes for domestic food use in products like tofu, soymilk and soy sauce, and 53,000 tonnes used for domestic animal feed and waste.

“All domestic production goes to food use,” the attaché said. “Future growth in overall soybean consumption is expected to be minimal.

“Consumption for crushing will be constant at the level of 1 million tonnes as long as CJ Corporation, the largest Korean soybean crusher, continues soybean crushing in their flexible crushing facilities, which are convertible depending on the comparison of crushing margins between rapeseed and soybeans.”

Milling/Flour

In an annual report published April 1, 2019, the USDA attaché cited figures from the Korea Feed Association (KFA) and Korea Flour Millers Industry Association (KOFMIA) showing 2017-18 milling wheat use in the country to be 2.186 million tonnes.

The attaché expected 2.6 million tonnes of the forecast 4.1 million of wheat to be imported in 2019-20 to be used for milling. The figure includes wheat and pasta imports on a wheat equivalent basis. Demand for milling wheat, therefore, was expected to remain steady.

According to the attaché, South Korea’s milling wheat suppliers are the United States, which sent 732,000 tonnes in 2018-19, followed by Australia (583,000 tonnes) and Canada (118,000 tonnes), with a further 3,000 coming from undefined other sources.

The (KOFMIA) website names seven large milling companies. They are Daehan Milling Co. Ltd., Sajo Dongawon Co. Ltd., Daesun Milling Co. Ltd., Samyang Corporation, CJ CheilJedang, Samhwa Powder Co. and Hantop Co. Ltd.

In a quarterly update on world trade in wheat flour published Jan 23, the IGC forecast South Korea’s flour imports in 2019-20 at 25,000 tonnes (wheat equivalent), down from its earlier forecast, made in September, of 50,000 tonnes.

Rice

In a Dec. 12, 2019, update on rice production, the USDA attaché cited figures released on Nov. 12, 2019, by KOSTAT showing the country’s 2019 rice production at 3.744 million tonnes, down on a September estimate of 3.780 million, and also down on the 2018 production of 3.868 million tonnes. The fall reflected lower area and yield.

The attaché explained in a Jan. 28, 2020, update that “under the 2019 rice Tariff Rate Quota (TRQ), Korea purchased a total of 408,700 tonnes of rice (milled basis) from three countries: the United States, China and Vietnam.”

The US share of that was 32.8%, 5.9 percentage points lower than in the previous year.

“The slow pace of sale auctions for imported table rice in Korea has continued since 2014, resulting in unsold imported rice accumulating every year,” the report said. “The unsold rice loses quality in storage over time and usually in Korea is then converted for alcohol processing.”

The attaché put Korea’s calendar year 2019 rice exports at just 52,663 tonnes, most of which was accounted for by a 50,000-tonne donation under the Food Assistance Convention (FAC), and a 1,000-tonne donation under the ASEAN Plus Three Emergency Rice Reserve.