ANKARA, TURKKEY — An unexpected wet spring has boosted harvest prospects for Turkey, which earlier in the year struggled with the lowest precipitation totals in 63 years and the fallout from devastating earthquakes.

More than 50,000 died in the February quakes and 3 million people were displaced. The damage mostly was localized to four provinces that are relatively small in terms of cereal production. With precipitation levels down 30% from October 2022 to this February, it initially was thought this drought would have a bigger impact on harvest than the earthquakes.

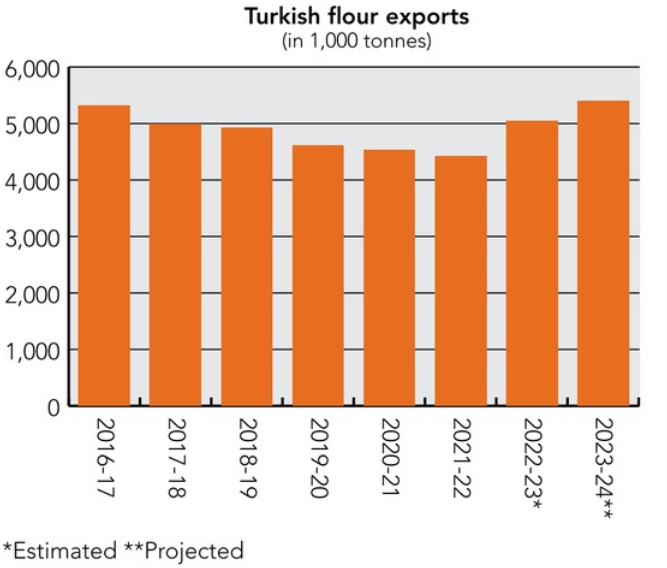

However, generous spring rains have improved harvest prospects with wheat production revised higher to 18.5 million tonnes and barley production forecast at 7.8 million tonnes, according to a July 27 report from the Foreign Agricultural Service (FAS) of the US Department of Agriculture. The nation is expected to ship a record 5.4 million tonnes of flour (wheat equivalent) in the 2023-24 marketing year.

Turkey is among the world’s top 10 agricultural producers and is a perennial leader in flour exports. Half of the country is arable land and almost 20% of its population is employed in agriculture.

Agriculture also makes a solid contribution to the nation’s economy, which is expected to see 3.6% growth in 2023. The earthquakes caused billions of dollars in direct losses, but the boost from reconstruction is expected to go a long way in offsetting the disruption to economic activity.

Crop production, consumption

The dry spell from Oct. 1, 2022, to Feb. 28, 2023, was somewhat compensated for by prolonged and heavy rains in the spring, the FAS said. Rainfall from March to June increased significantly from normal and the same period a year earlier. In June, rainfall increased 73% from normal and 8% from the previous June.

Total wheat production is estimated at 18.5 million tonnes, up from an initial estimate of 17.25 million tonnes.

“Better yields compared to last year due to improved weather conditions mostly offset production losses from the winter drought,” the FAS said.

Planted area is expected to increase 200,000 hectares to 7.2 million hectares due to stronger domestic wheat prices.

Wheat consumption is forecast at 21.1 million tonnes, up 700,000 tonnes from last year with an increase in feed usage.

Turkey is considered one of the largest consumers of bread in the world on a per capita basis.

“Due to the excess rain during the spring, domestic production is expected to be more suitable for feed usage while food seed and industrial consumption has steadily increased,” the FAS said.

Turkey is considered one of the largest consumers of bread in the world on a per capita basis. The government subsidizes a portion of the country’s bread production using imported and domestic wheat. Even with this support, the price of bread has increased because of rising labor and electricity costs to make the bread. The current price of bread is about 2.5 times higher than it was at the end of 2021, the FAS said.

First-crop corn (maize) planting is complete, with harvest starting at the end of August. Production is estimated at 8 million tonnes due to an expansion in the harvested area as farmers switch from lower-priced cotton. Corn planting area is estimated at 650,000 hectares, up from 530,000 hectares in 2022-23.

Corn consumption in 2023-24 is expected to increase 300,000 tonnes, to 9.2 million tonnes, based on strong demand for corn to make compound feed and starch. Feed manufacturers are expected to increase their use of corn because it is more price competitive compared to barley. Nearly 85% of corn is used to make animal feed while a much smaller amount is used for production of corn starch for food use.

Corn starch-based sugar production is regulated by the government through production quotas that are expected to decrease in size this year. Starch producers use about 900,000 tonnes of domestic corn each year. The starch industry’s annual production capacity is 1.5 million tonnes.

Turkey’s total production of oilseeds, including sunflower, cotton and soybeans, is estimated to decrease 17% to nearly 3 million tonnes due to different market dynamics, the FAS said. Factors include drought, the earthquakes and farmers switching to higher-value crops such as wheat and vegetables.

Soybean consumption in 2023-24 is estimated to increase 100,000 tonnes, to 3.15 million tonnes, on growing demand for use in poultry and aquaculture feed rations.

Trade

A 130% import tariff set on wheat, rye, oat, barley and corn starting on May 1 is expected to put downward pressure on grain imports in the 2023-24 marketing year. The tariff is the highest on imported grains since mid-2017, according to the FAS. The reason for the increase in tariffs was likely to protect local farmers from cheaper imports, it said.

“Demand for imports will also likely slacken because of large carryover stocks that were purchased from January-April of the current marketing year when the import tariff was zero,” the FAS said.

Turkey imported 12 million tonnes of wheat in 2022-23, a record level, because of the winter drought and elimination of the tariff until May.

Wheat imports for 2023-24 are estimated at 8.25 million tonnes, down from an original estimate of 10 million tonnes. The FAS said the total is enough to meet stable demand from wheat product producers and exporters.

Turkey imported 12 million tonnes of wheat in 2022-23, a record level, because of the winter drought and elimination of the tariff until May. About 70% of imported wheat is processed and reexported as flour and pasta.

Exports for the current market year are estimated at 7.25 million tonnes, slightly higher than 2022-23 due to better domestic durum wheat production. Wheat exports are predominantly flour, pasta and bulgur, which is made from imported wheat, the FAS said.

“However, there are rumors in the markets that durum wheat exports may be allowed in the coming months, which would dramatically increase the total wheat export numbers,” the FAS said.

With expected slower demand from Iraq, a key buyer, exports are expected to shift to other destinations in Near East Asia and sub-Saharan Africa, according to the International Grains Council (IGC).

Flour milling

Turkey produces more than 24 million tonnes of a wide range of wheat products, including flour, pasta, biscuits and more.

Bread production is subsidized by the government with the Turkish Grain Board (TMO) buying imported wheat and selling to local millers at a significant discount to domestic and international prices. Since last summer, that price has been about 30% lower than domestic prices.

Credit: ©SOSLAND PUBLISHING CO.

Credit: ©SOSLAND PUBLISHING CO.Millers sell the flour to private bakeries that produce and sell bread at a set price. The price varies from region to region and is fixed by the local government. About 60% of the country’s flour is made with wheat sourced from TMO, the FAS said.

Turkey has 598 flour mills in 69 provinces with a production capacity of 30 million tonnes per year, according to the Turkish Flour Industrial Federation (TUSAF). Key regions for flour production include southeastern and central Anatolia. Nearly 15,000 people are employed at the flour mills, TUSAF said.

Flour production is estimated at 15 million tonnes, or about 50% of capacity, although TUSAF said there is no official data.

According to industry sources, 10 small and medium-sized flour mills were damaged in the earthquakes. But with the industry operating at 50% capacity, the damage to these facilities is not expected to impact overall production, the FAS said.

“In other words, mills unaffected by the earthquakes can easily pick up the slack for those damaged facilities,” the agency said.

In addition to the flour mills, there are 24 active pasta factories with an annual production capacity of about 2 million tonnes, the FAS said. There are more than 140 factories that make bulgur, biscuits/cookies/crackers and semolina.