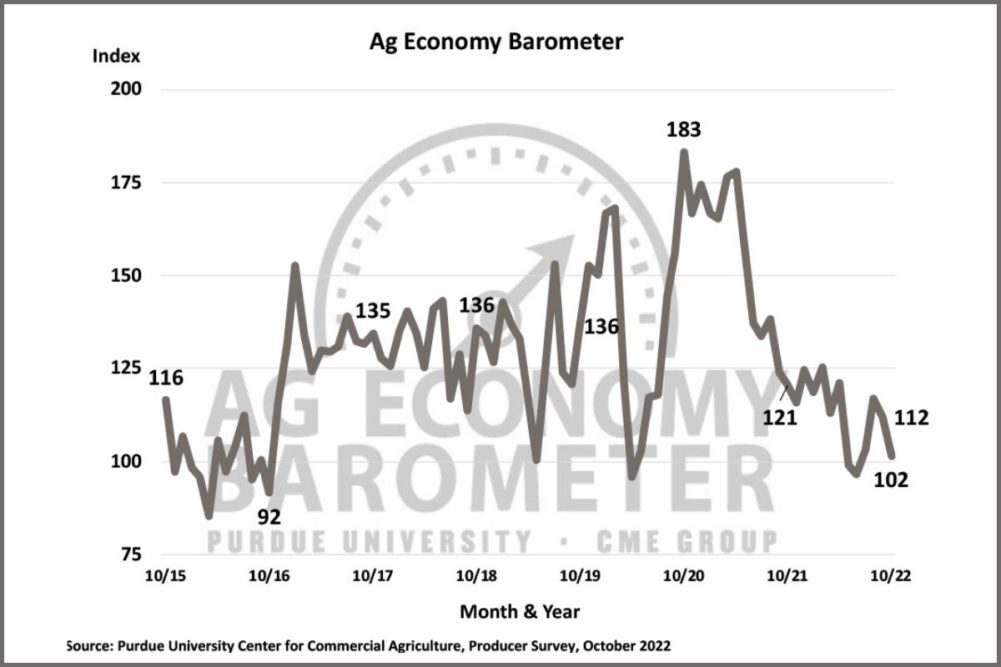

WEST LAFAYETTE, INDIANA, and CHICAGO, ILLINOIS, US – US farmer sentiment weakened again in October as the Purdue University-CME Group Ag Economy Barometer fell to a reading of 102, down 10 points compared to a month earlier.

Both of the barometer’s sub-indices – the Index of Current Conditions and the Index of Future Expectations – declined this month. The Current Conditions Index dipped 8 points to a reading of 101 while the Future Expectations Index dropped 11 points to a reading of 102.

Concerns about their farm’s financial performance was one of the drivers of weakening sentiment among producers.

“Concern over rising interest rates grew once again in October and is adding to the unease amongst producers who are worried about its impact on their farm operations,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Additionally, challenging shipping conditions throughout the Mississippi river valley have hampered exports recently and the corresponding widespread weakening of corn and soybean basis levels could be contributing to heightened unease about financial performance.”

Looking ahead to next year, over 40% of producers in the October survey view high input costs as their top concern followed by rising interest rates which was chosen by 21% of respondents. This month the percentage of producers choosing lower output prices as a top concern rose to 13%, matching the percentage of producers who chose input availability as a major concern.

After dipping to a new record low last month, the Farm Capital Investment Index improved this month to a reading of 38. The rise in the investment index was driven by a reduction in the percentage of producers who said now is a bad time to make large investments. Despite the index’s modest rise in October, the investment index remains mired near its all-time low. Once again, a follow-up question posed to producers who view this as a bad time for large investments revealed that increasing prices for farm machinery and new construction (40% of respondents) was the primary reason for the negative outlook. However, that was down from 49% who chose high prices two months ago as their top concern with rising interest rates (20%) and uncertainty about farm profitability (17%) coming in second and third, respectively.

The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 US agricultural producers’ responses to a telephone survey. This month’s survey was conducted from October 10-14, 2022.