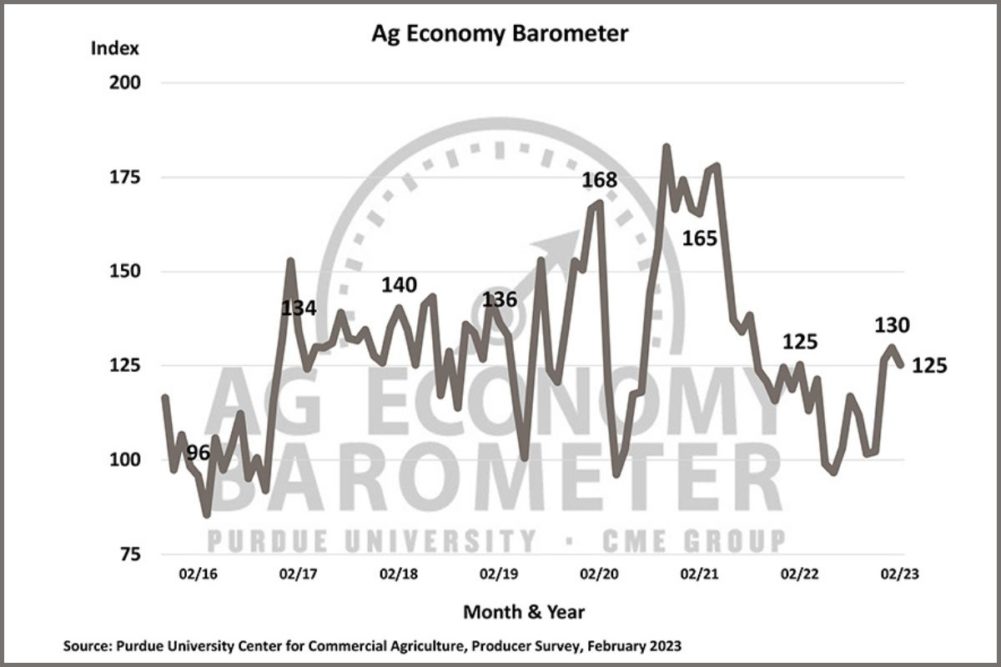

WEST LAFAYETTE, INDIANA, US — The Purdue University/CME Group Ag Economy Barometer dipped 5 points to a reading of 125 in February as US farmers’ perspectives regarding both current conditions on their farms and expectations for the future also weakened.

The Index of Current Conditions fell 2 points to 134 and the Index of Future Expectations declined 6 points to 121. The Ag Economy Barometer is calculated each month from 400 US agricultural producers’ responses to a telephone survey. This month’s survey was conducted Feb. 13-17.

“Increased concern over the risk of falling output prices, rising interest rates and uncertainty over the future growth of US agricultural exports is weighing on producers’ minds,” said James Mintert, the barometer’s principal investigator and director of Purdue’s Center for Commercial Agriculture.

Producers’ expectations for their farms’ financial performance in 2023 compared to 2022 weakened in February. The Farm Financial Performance Index declined 7 points to a reading of 86. Farmers continue to point to concerns about higher input costs (38% of respondents), rising interest rates (24% of respondents) and lower output prices (18% of respondents) as their biggest concern for the year ahead.

Agricultural exports have been a key source of growth for US agriculture for decades. Beginning in 2019, the Ag Economy Barometer survey routinely included a question asking producers about their expectations for agricultural exports in the upcoming five years. Since peaking in 2020, when just over 70% of respondents said they expected exports to increase in the upcoming five years, the percentage of farmers looking for exports to grow over time has drifted lower. In February, just 33% of survey respondents said they expect exports to increase, which led Mintert to suggest that a lack of confidence in future agricultural export growth is contributing to weakened sentiment among producers.

Despite strong farm income, the February reading of the Farm Capital Investment Index changed little, rising 1 point to a reading of 43. This month 72% of producers said it is a “bad time” to make large investments in their farming operation, while just 15% reported it is a “good time” to make such investments. The disparity between producers’ responses to the question and actual farm equipment sales continues to be focused on costs. Of those who said now is a “bad time” to make large investments, 45% of respondents said it was because of an increase in prices for farm machinery and new construction, while 27% of respondents said it was because of “rising interest rates.”

Each February, the barometer survey includes a question focused on farm growth, asking respondents about the annual growth rate they expect for their farm over the next five years. This year 49% of respondents said their farm either had “No plans to grow” (33%) or “Plan to exit or retire” (16%). Of those respondents who expect their farms to grow, 19% expect it to grow by “Less than 5% annually,” and 22% said they expect it to grow by “5% to 10% annually.”

Read the full Ag Economy Barometer report atpurdue.ag/agbarometer.