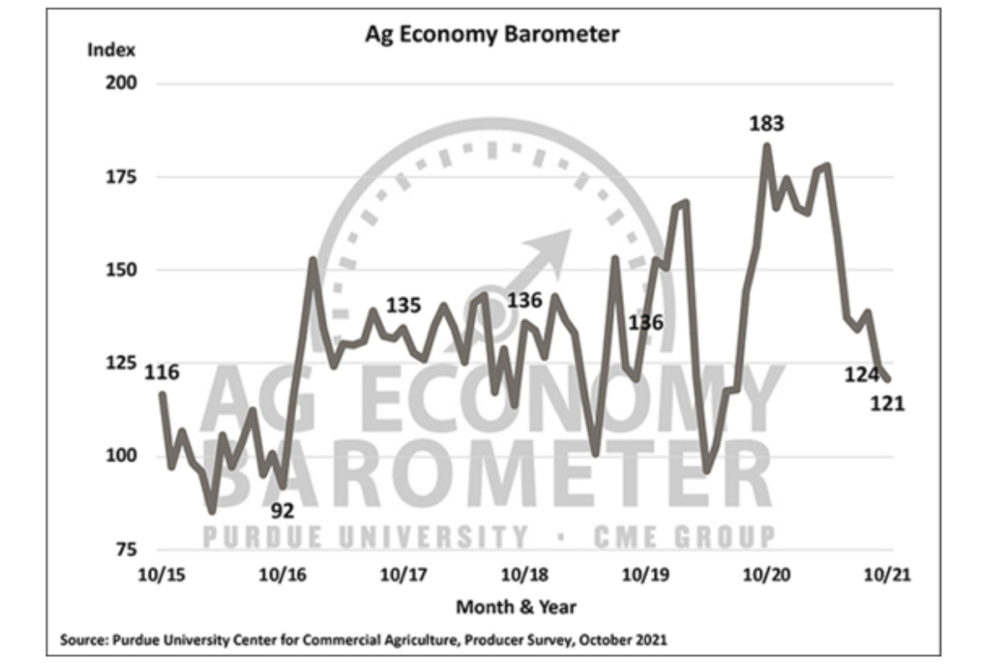

WEST LAFAYETTE, INDIANA, US — US producer sentiment fell for the third straight month as the Purdue University/CME Group Ag Economy Barometer dropped 3 points in October to 121, according to results from the monthly survey released on Nov. 2.

The modest drop was primarily due to producers’ weakened perceptions for both current and future conditions in the production agriculture sector. The Index of Current Conditions was down 5 points to a reading of 140, while the Index of Future Expectations fell 2 points to a reading of 114.

The Ag Economy Barometer is calculated each month from 400 US agricultural producers’ responses to a telephone survey. This month’s survey was conducted between Oct. 18-22.

“Recent weakness in farmer sentiment appears to be driven by a wide variety of issues, with concerns about input price rises topping the list,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Rapid run-ups in input prices, especially fertilizer for crop production, are giving rise to concerns among producers’ about their operating margins weakening. Livestock producers are also concerned about a cost-price squeeze, especially in the pork and dairy sectors.”

Producer’s view of their farms’ financial situation was less optimistic in October compared to September. The Farm Financial Performance Index declined 6 points to 104 in October. Over half (51%) of producers in the survey said they expect input prices to rise 8% or more in the upcoming year and one-third of producers said they expect those prices to rise by 12% or more. While the dramatic rise in fertilizer prices that has taken place in recent months is a key factor, rising input costs also extend to other inputs such as seed, pesticides, and machinery repairs and ownership costs, leading farmers to become increasingly concerned about a cost-price squeeze on their operating margins, said Mintert.

Rising input costs are starting to have a dampening effect on expectations for farmland cash rental rates. In October, the percentage of corn and soybean producers expecting higher farmland rental rates in 2022 compared to 2021, dipped to 43%, down 7 points from September, with more respondents expecting rates to remain unchanged in the coming year. Despite these concerns, producers remain bullish on farmland values. The Long-Term Farmland Value Expectations Index set a new record-high this month with a reading of 161, 2 points higher than a month earlier while the short-term index rose 1 point to 156.

Over the past year, there’s been little change in producers’ awareness of carbon capture opportunities on their farms. Just 29% of respondents in the October survey said they were aware of opportunities to receive payments to capture carbon on their farms, on par with survey results from last winter and spring. Of those aware of the opportunities, just over 2% said they had discussed carbon capture payments with any companies, compared to 5% last winter and spring.