The new decade has started with a more bullish tone in the rice market, with prices higher in the United States and Thailand. A trade deal between the United States and China offers encouragement for U.S. rice exporters.

The US Rice Producers Association said in its Jan. 16 Rice Advocate publication that “Asian benchmark pricing has continued to escalate over the past week with all of the notable origins posting positive pricing.”

“Fundamental supply and demand factors are at play in that sphere,” US Rice said, pointing to the bullish trend that has emerged. “The Gulf states are all but out of rice and a virtual bidding war has broken out amongst buyers in order to secure the remaining lots and cover medium-term commitments. The Delta region has also experienced a boost in pricing and regardless of quality, can be expected to note larger sales volumes in the near future.”

The US Rice Producers Association also reported on the Jan. 15 signing of a trade deal with China, citing USDA estimates that it could mean rice exports reaching $300 million a year.

A US government fact sheet on the phase one economic and trade agreement explains that under a phytosanitary protocol the deal will mean that China is obliged to allow imports from US facilities within 20 days of receiving the latest list showing their approval by the Animal and Plant Health Inspection Service (APHIS).

The fact sheet also highlights China’s agreement to comply with its obligations on tariff rate quotas (TRQ) for rice and allocate the full TRQ by January of each year.

“When joining the World Trade Organization (WTO), China agreed to establish a 5,320,000-tonne tariff rate quota for rice, equally divided into long-grain and other rice,” it said. “With the completion of both the phytosanitary protocol and this agreement, the US rice industry will now have greater opportunities to export milled rice to China.”

In its Rice Outlook for January, published Jan. 14, the USDA’s Economic Research Service said market prices for most grades of Thailand’s non-aromatic rice have risen 5% to 6% over the past month, “mostly due to concerns over a much-diminished dry-season crop that will begin harvest in March and a continued strong baht.”

“Thailand’s 100% Grade B long-grain milled rice for export remains quoted at $428 per tonne for the week ending Jan. 6, up from $407 for the week ending Dec. 9 and the highest since mid-August,” the ERS said. “In contrast, prices for Thailand’s premium aromatic rice — quoted at $1,113 per tonne — are unchanged from a month earlier.

“Vietnam’s 5% broken kernels long-grain milled rice is currently quoted at $347 per tonne, down $3 from mid-December but up $2 from the beginning of December. Vietnam’s prices are currently more than $70 below prices for comparable grades of Thailand’s rice, making Vietnam a price-competitive supplier.”

The ERS described prices quoted from exporters in South America, where the harvest is expected to begin by April in the southern area that is the source of the bulk of exports, as virtually unchanged.

“US trading prices for long-grain rice increased over the past month, with prices for U.S. long-grain milled rice, Number 2 Grade, 4% broken kernels (free on board a vessel at a Gulf port) currently quoted at $570 per tonne, up $10 from early December,” the USDA agency said. “US long-grain milled prices are currently being supported by recent large sales to Haiti and expectations of much tighter supplies later this market year.”

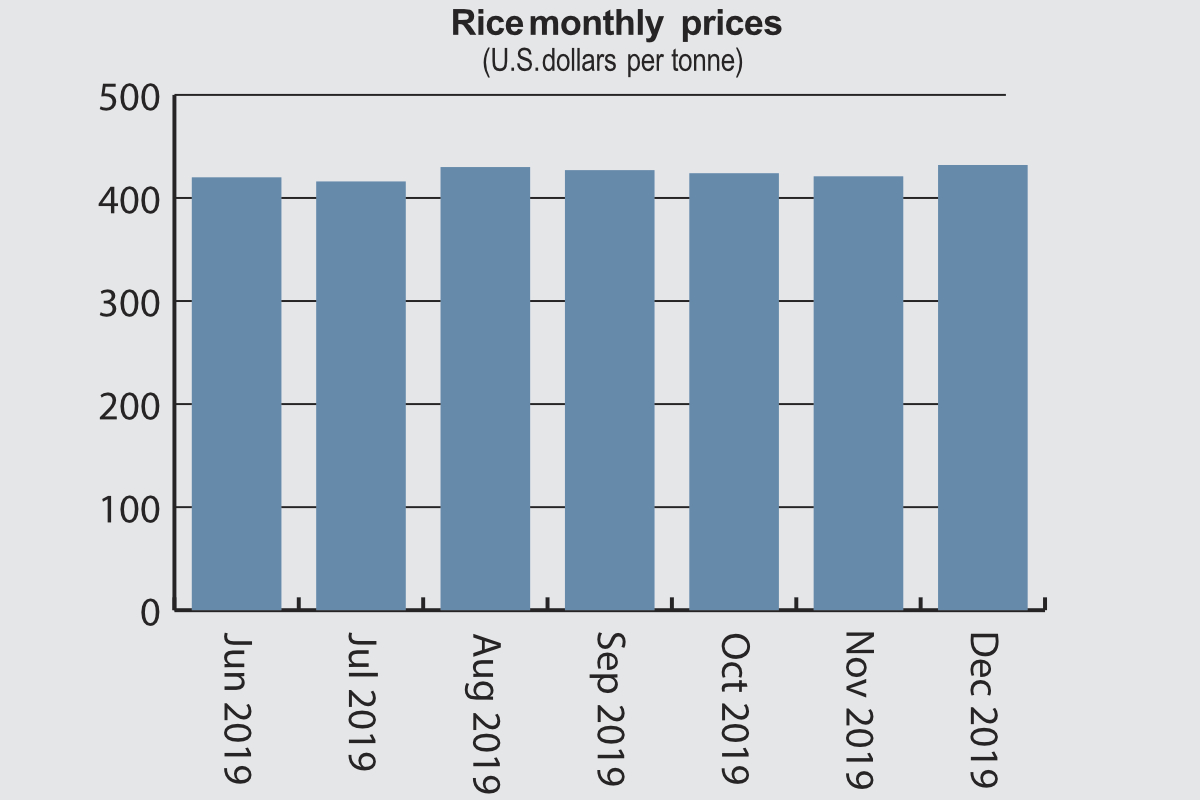

The FAO said on Jan. 9 that rice prices changed little in December, as seasonal declines in fragrant quotations outweighed gains in the Indica segment, where supply constraints provided some support to prices. It had reported a 1.5% fall in global rice prices from October to November.

International rice prices in the first 11 months of 2019 were 0.6% below year-earlier levels, as declines in Indica quotations were partly offset by gains in Japonica and fragrant prices, the FAO said.