Weather uncertainty in the United States has helped to keep the wheat market volatile in recent weeks, while production woes in North America are one of the factors contributing to the expectation that Russia will remain the dominant wheat exporter in the coming year.

In its Agri Commodities Monthly Report for May, published May 29, Rabobank said that U.S. rainfall had resulted in a 20% increase in Chicago wheat prices so far in May, with MATIF rising by 10%.

“Kansas and Oklahoma received up to 400% of normal precipitation in the last 30 days, and both continue to face a higher probability of wetter and cooler weather ahead,” Rabobank said. “Winter wheat protein content will likely suffer, and chances of crop infection from fungi and mycotoxins have increased.

“The amount of U.S. spring plantings that are prevented by the rainfall is likely going to be very small, compared to corn. We will likely see continued price volatility. But the market will soon again shift its attention to production forecasts for other key producing regions.”

Rabobank also noted that Australia faced a “dryness or related subdued harvest,” in 2019-20.

“Australia has needed to import wheat this month, for the first time in more than a decade,” Rabobank said.

“The Black Sea will soon take center stage in pricing,” the Dutch bank’s analysis continued. “With weather worries in the U.S., along with poor planting and growing conditions in Australia, the wider European region is key to global supplies.”

The E.U. raised its 2019-20 soft wheat production estimate to 143.8 million tonnes, up from 141.3 million tonnes a month earlier.

“The weather has been a little drier than normal in France and parts of Germany so far this season,” it said. “Production and export estimates for Russia have also continued to trend upwards, due to relatively good weather and sufficient soil moisture. We still expect a strong supply out of the region that could and pressure on CBOT and MATIF wheat.”

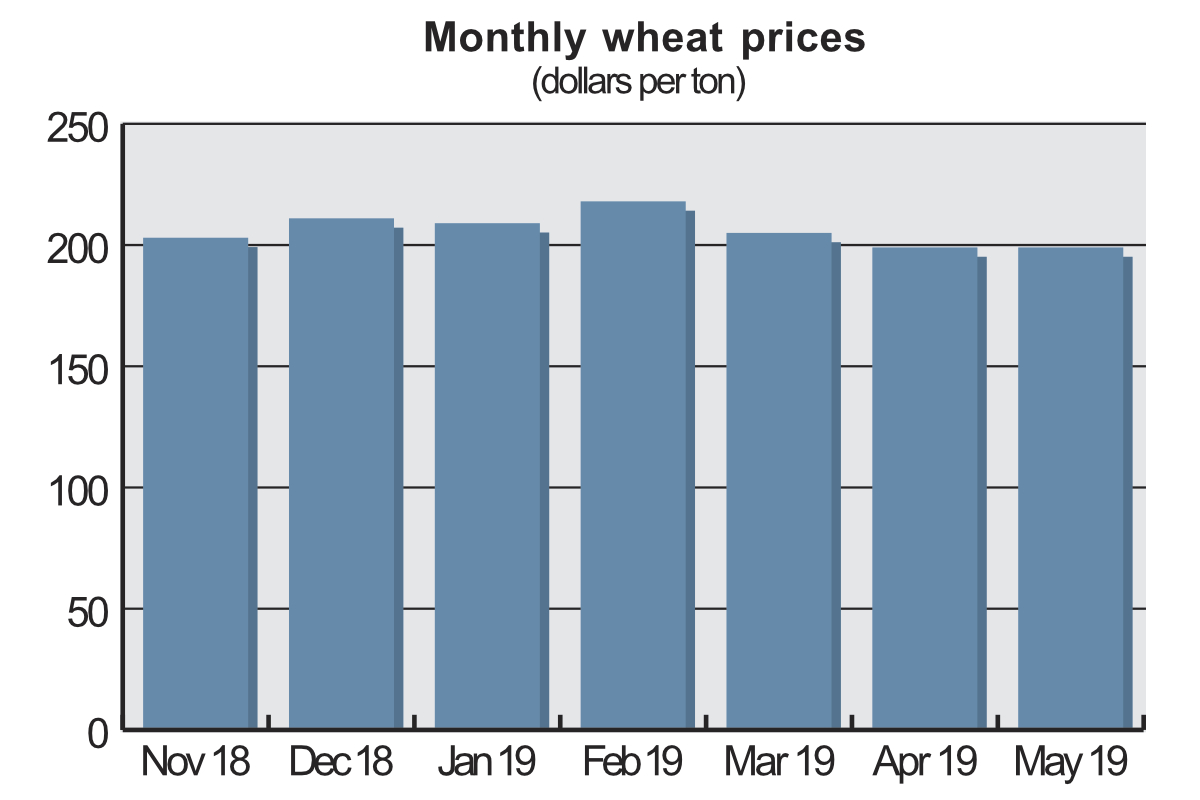

In its Grain Market Report on May 30, the International Grains Council (IGC) reported that its index for wheat had rallied by 4% over the preceding month, “as initial weakness was outweighed by more recent gains.”

“Expectations for plentiful global supplies in 2019-20 contributed to the soft tone in the first part of May, underscored by the USDA’s initial projections for next season, which pointed to a bigger world harvest and record stocks,” the IGC said “There was added pressure from lackluster export demand, as well as world trade tensions.

“However, markets turned much more positive later in the month amid uncertainties about crop prospects in some regions. Escalating concerns about the impact of overly wet weather for U.S. crops was the main focus, but there was additional price support from dryness in Australia and Canada, as well as nervousness about forecasts for a spell of hot weather in Russia.”

The USDA’s Economic Research Service’s Wheat Outlook report for June, published June 13, said that “global wheat production in 2019-20 is projected to reach a new record of 780.8 million tonnes, up 3.3 million this month.”

“This figure is 49.1 million tonnes higher than last year and 18.9 million tonnes above the 2017-18 record,” the ERS said. “Most of the increase, both monthly and yearly, is in foreign (world minus the U.S.) wheat production. Two major wheat grain exporters — Russia and Ukraine — as well as India, have seen their production prospects increased.”

The ERS said 2019-20 wheat exports from Russia are now forecast at 37 million tonnes, a revision upwards of 1 million, due to expected higher production of winter wheat in the southern part of the country.

About 500,000 tonnes has been added to Ukraine’s export forecast, bringing it to a record 19.5 million, on increased production expectations. Competition from Russia and Ukraine means that the U.S. experts now expect the E.U. to export 500,000 tonnes less wheat than earlier forecast, while Australia will suffer from Black Sea competition in its traditional Southeast Asian export markets.