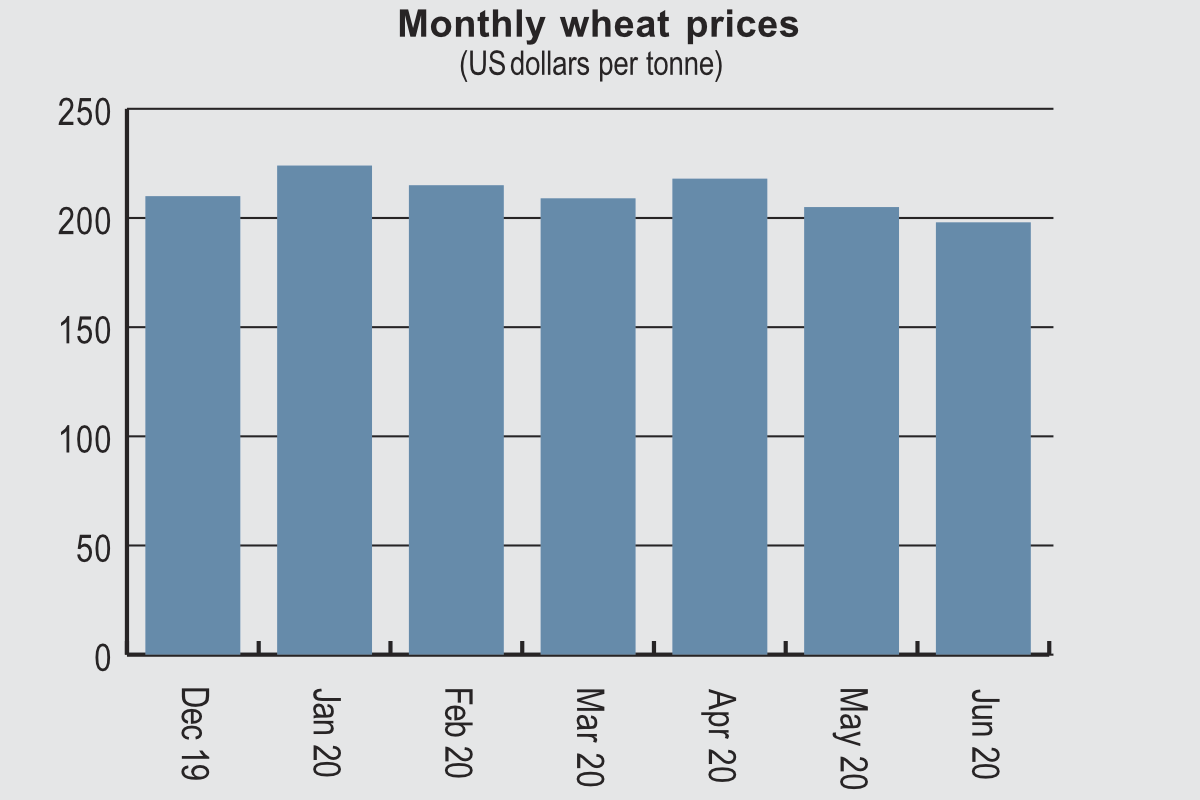

World market wheat prices have trended lower in recent months, despite reduced production forecasts for some important producing areas, on the expectation of ample supplies in the new marketing year.

In its Grain: World Markets and Trade report, published July 10, the Foreign Agricultural Service (FAS) of the US Department of Agriculture reported price declines for most major exporting countries during June, mainly because of seasonal pressure ahead of a forecast record world harvest.

“Russia was pressured lower as harvest approaches with relatively favorable conditions to date,” it said. “EU prices declined despite some lingering concerns over dryness in some Member States. Canada’s prices also declined on seasonal pressure and expectations for a large crop. US prices moved lower as well with the US winter wheat harvest now more than halfway complete.”

The FAS described Australian prices as having “plummeted as quotes now reference new-crop prices, which reflect expectations of a much larger crop. On the other hand, Argentina edged higher on seasonally tightening supplies. Prices rebounded in recent days with expectations of smaller crops in the European Union and Russia.”

In its July 14 Wheat Outlook report, the Economic Research Service (ERS) of the USDA said notable reductions in the upcoming wheat crops in the EU and United Kingdom, Russia (but only for winter wheat), Morocco, Mexico and the United States had triggered a cut in the Department’s forecast for global wheat production of 4.49 million tonnes, bringing it to 773.4 million.

“Wheat production for the EU fell further this month, down 1.5 million tonnes, to 139.5 million, more than 15 million tonnes below last year’s production, but still above the drought-affected 2018-19 harvest of 136.7 million,” the ERS said.

The forecast wheat area was unchanged from the previous month, but yields were reduced by a further 1% compared with the earlier forecast.

“Conditions for the EU wheat crop have been described as both variable and challenging,” the ERS said. “At the outset of the fall planting season, excessive rainfall delayed and, in some cases, prevented planting — mostly in northwestern Europe. The wet fall was followed by the second warmest winter on record, which dried down fields and sapped soil moisture levels. Prolonged dryness throughout the spring and into the summer months led to the expansion of drought across the continent, negatively affecting soil moisture levels, wheat conditions and yields. Dry conditions during much of the growing season accelerated the maturation of the 2020-21 EU wheat crop. Considering the wheat crop’s relatively advanced maturity, June rains are expected to have had a minimally positive impact on the wheat harvest.”

Winter wheat production in Russia is lowered 1 million tonnes in July to 56 million while spring wheat is increased 500,000 tonnes to 20.5 million, the ERS said, adding that net Russian production is lowered 500,000 tonnes to 76.5 million.

The International Grains Council (IGC) said in its Grain Market Report at the end of June that world wheat prices were mostly lower, although a 4% drop in its wheat sub index reflected a change to new crop quotations in some regions.

“While uncertainty about production prospects in Europe and the Black Sea region continued to provide price underpinning, any upward moves were contained by expectations for overall world supplies to be ample in the year ahead,” the IGC said. “There were conflicting ideas about the impact of recent rains for European and Black Sea crops, with some analysts believing the precipitation came too late for certain areas to reverse earlier damage from dryness. In general, forecasts for European production continued to come down during the month, which provided price support to world prices, but some expectations for the harvest in Russia moved higher.”

The London-based IGC also noted that uncertainty over the potential effect of COVID-19 on demand weighed on sentiment, something that was exacerbated by a resurgence of the virus in some countries where lockdowns were being eased.

“Generally subdued new-crop import buying interest underscored the uncertain demand outlook and contributed to the soft price tone, but there were signs of improved import buying interest as the month progressed,” the IGC said.