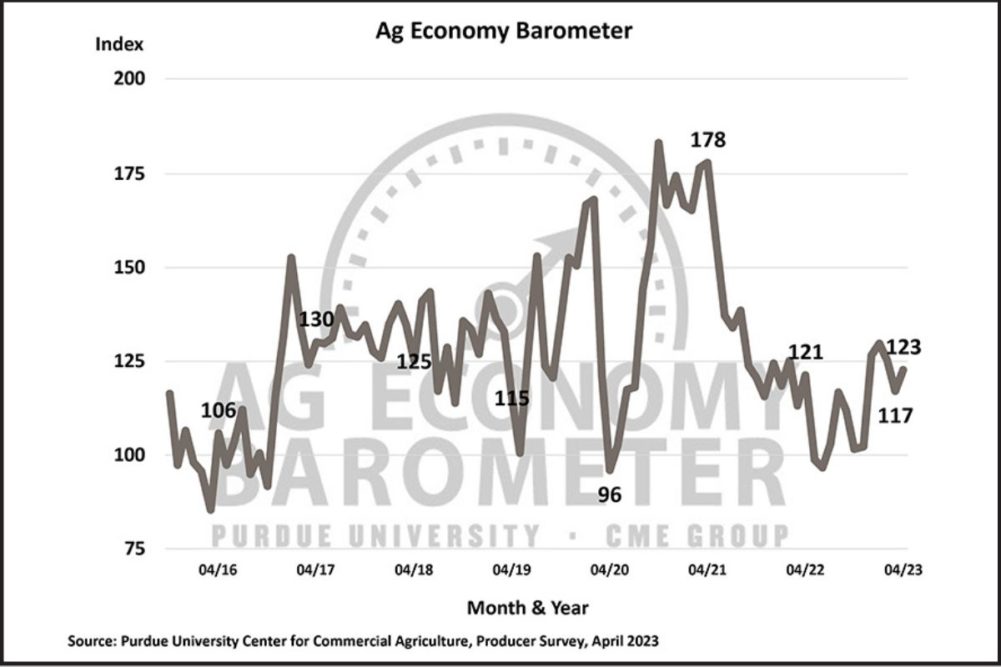

WEST LAFAYETTE, INDIANA, US — Sentiment among US agricultural producers improved modestly in April as the Purdue University/CME Group Ag Economy Barometer, calculated each month from 400 US producers’ responses to a telephone survey, rose 6 points to a reading of 123.

Both the barometer’s sub-indices were also higher in April. The Current Conditions Index was up 3 points to 129 and the Future Expectations Index was up 7 points to 120.

“Producers held a more optimistic view of the agricultural economy in April,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “A shift in farmers’ expectations regarding the Fed’s future interest rate policy could be a key reason.”

The Farm Financial Performance Index also improved this month, up 7 points to a reading of 93. The prime interest rate charged by US commercial banks increased from 7.75% in January to 8% in late March, and since the February barometer survey, there has been a noticeable shift in farmers’ interest rate expectations. In April, 34% of respondents said they expect the US prime interest rate to remain unchanged or decline over the next year, compared to 25% of producers who felt that way in February. At the same time, two-thirds (66%) of producers expect interest rates to keep rising, compared to 75% of respondents who felt that way in February. However, the biggest shift was a decline in the percentage of respondents who expect rates to rise between 1% to 2% in the next year, down 6 points since February to 37%.

The Farm Capital Investment Index increased one point to a reading of 43 in April, yet more than 70% of respondents continue to feel now is a bad time for large investments. In the April survey, 39% of respondents cited “rising equipment and construction costs” while 33% cited “rising interest rates” as the top reason for now being a bad time for such investments.

Producers’ expectations for short-term farmland values increased in April following five-straight months of decline. The Short-Term Farmland Value Expectations Index rose 10 points in April to a reading of 123, while the long-term farmland index held steady at a reading of 142. Even with the increase, the short-term index remains 21 points lower than a year earlier and 36 points lower than two years ago.

The April survey included questions to learn more about producers’ perspectives on the upcoming farm bill discussions. When asked about the likelihood that a new farm bill will be passed this year, 12% of respondents think it’s very likely, 28% said somewhat likely, 16% said somewhat unlikely, and 13% said very unlikely. The survey also questioned corn and soybean producers on what they consider to be the most important aspect of a new farm bill. Of those respondents, 40% chose crop insurance, 31% chose commodity programs, 13% chose conservation, 8% chose agricultural research and extension, and 8% chose renewable energy as a top priority to them.

Read the full Ag Economy Barometer report here.