Grain export restrictions embarked on by Russia and Kazakhstan during the first few months of the COVID-19 pandemic brought a hiatus upon the food supply chain in several countries in 2020. A big question now is whether 2021 will be any better.

The Kazakh export restrictions had the potential to doom the country’s neighbors to starvation, local market participants claimed in March 2020. Now, almost a year into the pandemic, the fears over food security in some countries keep mounting since new export restrictions continue to drive prices up.

Russia’s Economic Development Ministry recently submitted a proposal to the government to impose a wheat export tax of 25 euros ($30) from Feb. 15 to June 30, Economic Development Minister Maxim Reshetnikov said at a recent government meeting.

The quota is proposed to be set at 17.5 million tonnes for the same period, 2.5 million tonnes above the original plans. Above the quota, export supplies would be subjected to a 50% tax, not lower than 100 euro ($125) per tonne. The quotas are needed to stabilize the price situation on the domestic grain market, which has seen rising prices recently, he explained.

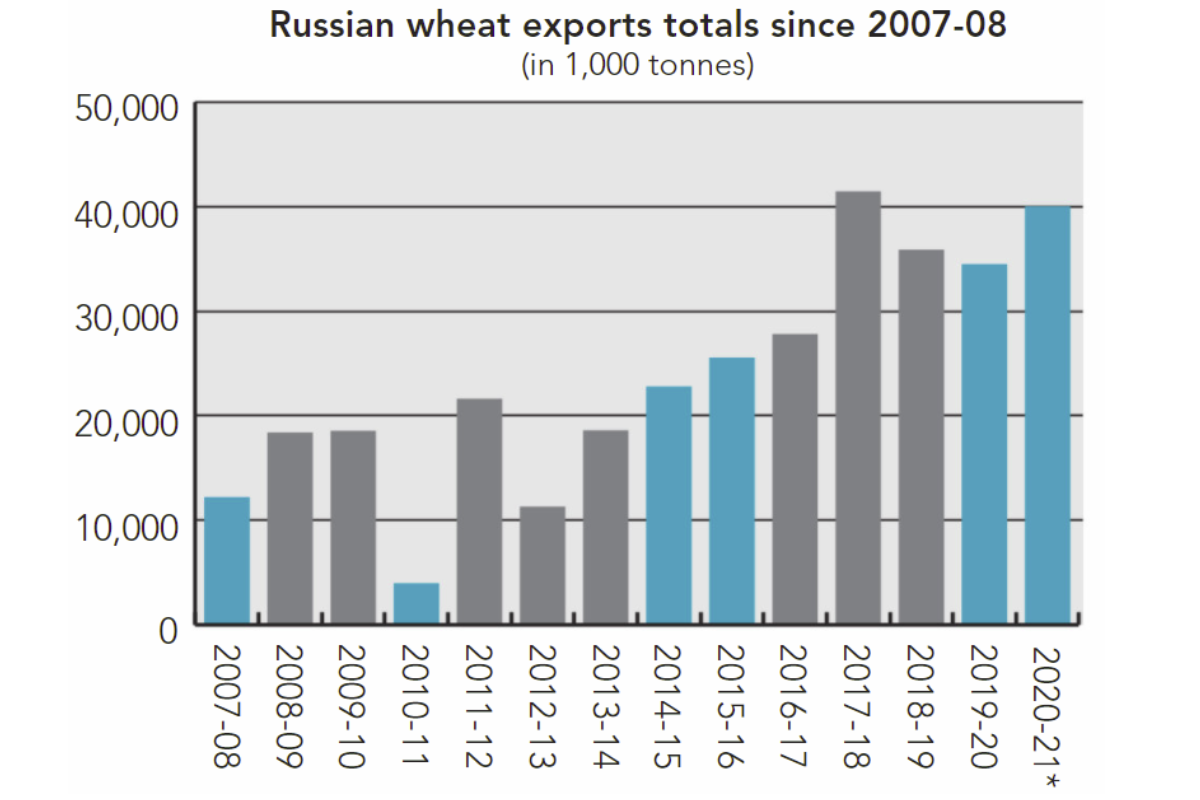

“Russia was expected to export 51 million tonnes of grain, including 40 million tonnes of wheat in the 2020-21 season, but the introduced export tax is likely to curb these figures,” said Arcady Zlochevsky, president of the Russian Grain Union.

In light of the export tax introduction, Russian grain becomes less competitive on the global market. For instance, at the GASC tender in Egypt, Russian wheat exporters lost for the first time in six months to some Ukrainian and Romanian suppliers. Russian analysts pointed out that the Russian wheat was always attractive pricewise, but now it is more expensive than that of other Eastern European countries, which is a warning sign.

Although Kazakhstan and Ukraine have announced no quotas, grain supplies in Central Asia are likely to be tight, unleashing serious problems for some of the local economies.

Turkmenistan struggles with grain shortage

In Turkmenistan, the 2020 harvesting campaign turned out to be extremely tense, as the government had to deploy law enforcement to grain harvests to prevent farmers from hiding grain, according to the Vienna-based Turkmen Initiative for Human Rights (TIHR).

“Right before the beginning of the harvesting campaign, the regional authorities, police, and tax office have been visiting farms running their own mills to shut them down so that all grain ended up in the state warehouses,” said TIHR spokesperson Farid Tukhbatulin.

Struggling against the grain shortage, the government also ordered state-owned farms to increase grain production compared to the previous year. The targets set by the government in most cases were unrealistic, local farmers claimed.

Speaking with farmers, Turkmenistan President Gurbanguly Berdimuhamedow stressed that grain output could be boosted to 4.5 tonnes of grain per hectare on average, although the actual figure is standing at 3.7 tonnes to 3.8 tonnes. In 2020, Turkmenistan collected 1.4 million tonnes of wheat. In the previous years, the government officials estimated the domestic demand at 1.6 million tonnes or 1.7 million tonnes.

Local citizens are no strangers to food shortages, which are linked to the domestic grain market situation. In 2017, the authorities had to temporarily prohibit citizens from purchasing more than 50 kilograms of flour per household per month. At that time, Turkmenistan struggled with a lack of food as the domestic grain harvest hit a record low of 1 million tonnes. However, the relatively good grain harvest and unprecedented state control over grain fields this season have not prevented problems in the food industry and economy as a whole. The Central Bank of Turkmenistan’s exchange rate has remained at 3.5 manats per US dollar for the last five years, but on the black market, the exchange rate hit 25 manats per US dollar — the highest figure ever, sparking inflation and making citizens poorer than ever.

In May 2020, the government introduced a food stamps system to guarantee at least some level of food security to the population. The authorities remain silent on what independent media describe as a full-fledged food crisis. Still, local market participants estimated that up to 35% of the local population might be short of food in 2020.

“Kazakhstan, Iran, and Russia, which were saving the country in these situations with emergency grain supplies in the past, due to the pandemic are stripped of this opportunity, or use it differently now, as Tajikistan and Kirgizia are also in need,” said Natalia Kharitonova, expert at the International Crises Research Center.

Tajikistan, Kirgizia braced for famine

The other Central Asian countries also are experiencing huge economic problems, which, coupled with trade barriers on the global market, reportedly could put thousands of households on the brink of starvation.

“To import some products, we need currency,” said Tajik economist Pairav Chonsharviev. “The value of import is three times that of the value of export, and we have a shortage of foreign currency of $3 billion per year. The lack of the currency is compensated with transactions from migrants, which means that food security is dependent on these transitions.”

Millions of citizens of Turkmenistan, Tajikistan, Kirgizia, and Uzbekistan work in Russia primarily in the construction industry and food retail. In Tajikistan, migrant transactions totaled $2.7 billion in 2019, or 33.4% of the country’s GDP. The picture is similar in the neighboring countries. However, due to the pandemic, quite a few migrants had to return home, leading to reduced cash flow.

According to Radio Azattyq, meat and butter are considered luxuries now in Tajikistan as the country faces a steep price hike. Prices for some food jumped by nearly 30%, driven by expensive grain and feed. This is a nightmare for some of the world’s poorest countries where, according to the World Food Programme calculation, 47% of the population lives on less than $1.33 per day, and nearly 30% is consistently short of food.

During the first nine months of 2020, Tajikistan imported 650,000 tonnes of wheat, with most supplies coming from Russia and Kazakhstan. Local market participants are concerned about new export quotas in 2021.

“The (Russian) protectionist policy is likely to calm down their domestic market but further heat up the grain market in the region,” said a Tajik farmer who asked to remain anonymous. “The export prices are climbing in dollars, but for Tajikistan, the prices are also jumping because of our currency’s depreciation. This will impact everyone tremendously, as the government has no idea what to do about it, since their (national budget) incomes dwindled, and they cannot help those millions on the edge of starvation.”

Before the pandemic, the average Tajik citizen lacked on average 223 calories per day, research conducted by the Economist Intelligence Unit showed. By comparison, in neighboring Uzbekistan, this figure is limited to 43 calories, and in Kazakhstan it is only 17 calories.

To battle very similar problems, the Kyrgyzstan government announced plans to boost the domestic grain harvest to 1 million tonnes to meet the domestic demand.

“In 2020, we plan to collect 700,000 tonnes, while in coming years we hope to push this figure to 1 million tonnes,” Kyrgyz Agricultural Minister Erkinbek Choduev said during a press conference in 2020. “For this reason, we plan to expand the arable land territory to 300,000 hectares.”

However, the Kyrgyz flour milling companies committee warned that the dependence on imported grain in the country was close to 60% or 70% in 2019, and “the present situation was extremely dangerous, as it could cause famine.”

“Even in the Soviet time, when there was a death penalty for (grain) stealing, the 1-million-tonne target of grain (production) was never beat,” said Rustam Gunushev, chairman of the Kyrgyz flour milling companies committee. “These statements are nothing more than populism.”

Kyrgyzstan’s economy is facing similar challenges as Turkmenistan and Tajikistan — rampant inflation and skyrocketing prices for almost all food products on the grocery shelves. There’s also fears the pandemic could jeopardize agriculture in Turkmenistan, Tajikistan, Kirgizia, and Uzbekistan since all these countries are heavily dependent on imported fertilizers, seeds, and equipment and have no currency to pay for them.

Uzbekistan coping better

Uzbekistan is the biggest grain importer in Central Asia. It produces 5 million tonnes of grain per year, importing 2.5 million tonnes. So far, it has navigated the pandemic relatively well, avoiding deepening poverty, empty shelves, or food stamps, according to the Uzbek authorities. The Uzbek government has constrained the rise in food prices on the domestic market by accumulating huge stocks before the pandemic and exempting all food imports from VAT since April 2020. But, the country’s food prices still jumped by 26% in January-October 2020.

“If we do not take the necessary measures today and change the current system, tomorrow — in winter and spring — the situation will become more complicated,” Uzbekistan President Shavkat Mirziyoyev said during a recent government meeting.

Vladislav Vortonikov is a correspondent from Voronezh, Russia. He may be reached at [email protected].