Corn prices have started 2021 with sharp rises as a cut in forecast US production added to supply concerns elsewhere to create a strong bull market.

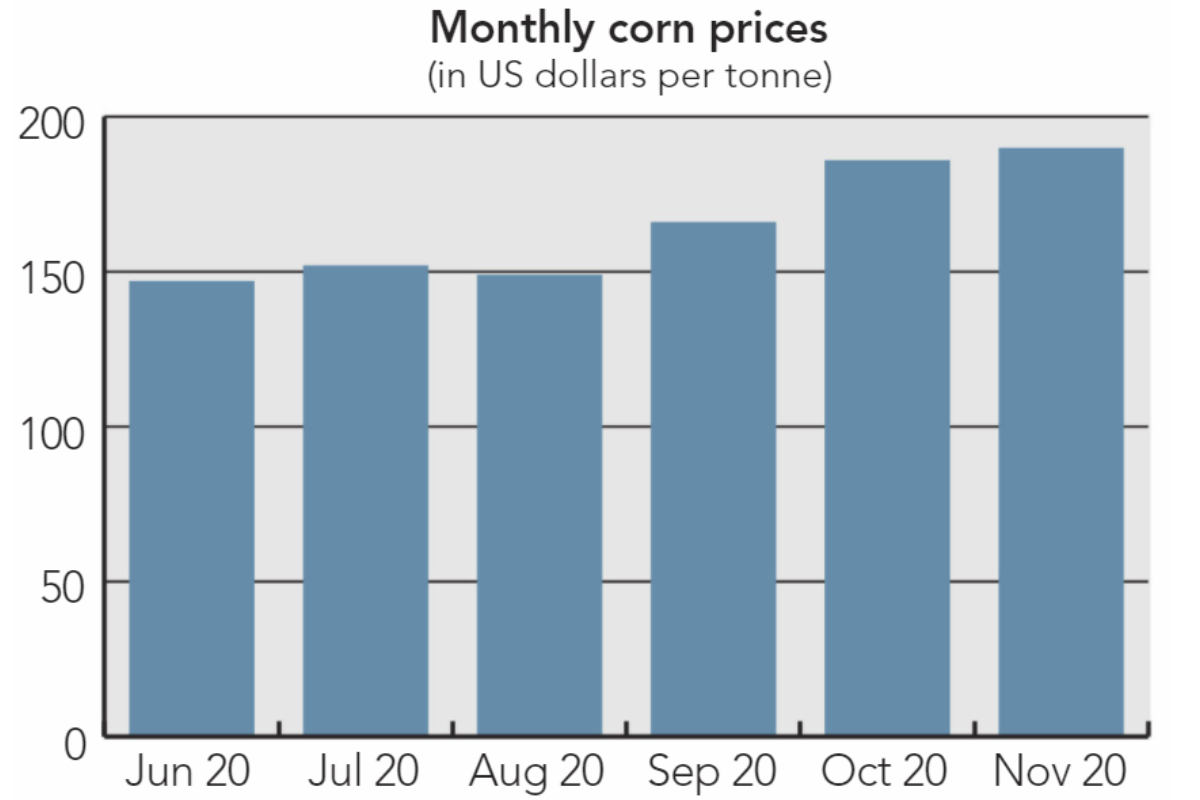

The International Grains Council (IGC) said in its Grain Market Report of Jan. 14 that “against a backdrop of generally robust export demand and increasingly tight global supply prospects,” its index for corn prices rose by 13% since the report’s previous edition, published on Nov. 26, 2020, reaching the highest level in seven-and-a-half years.

“With values trending almost exclusively higher since mid-December, US futures (March) gained by 23% in the seven weeks from the last report; the spot contract rising to its highest since July 2013,” the IGC said. “Much of the increase stemmed from bullish fundamentals, notably robust demand for US supplies and worries about South American production, with news of firming prices in China and export restrictions in Argentina also influential.”

While spillover from a soybean futures rally underpinned at times, the most recent upsurge was linked to the USDA’s unexpectedly small domestic crop estimate, the IGC said.

The IGC also noted that “recent shipments out of Argentina were hampered by strike action, while below-normal precipitation rekindled worries about logistics on the Paraná River, the key shipping waterway.”

“Up River premiums were buoyed by lingering worries about the next harvest and export policy uncertainty which, coupled with gains in CME futures, propelled export prices $35 higher, to $263 fob,” the IGC said. “The market in Brazil was mostly quiet amid thin exportable availabilities, with nominal Paranaguá prices assessed at $275 fob, $37 more than in late November.”

The Economic Research Service (ERS) of the USDA said in its Jan. 14 Feed Outlook report that “global coarse grain production in 2020-21 is projected lower this month at 1.438.5 billion tonnes, down 9.3 million, mostly because of a decline in the United States.”

“Lower estimated US output drives global change, with foreign coarse grain production forecast down 1.1 million tonnes to 1.063 billion,” the ERS said. “Global corn projections changed the most, down 9.7 million tonnes to 1.133 billion tonnes, while changes for some other coarse grains are small.”

The biggest revision for corn production outside the United States was for Argentina, with a reduction in the crop projection of 1.5 million tonnes, bringing it to 47.5 million.

“Last month, a production reduction in Argentina was caused by lower projected planted area,” the ERS said. “This month, persistent dryness affected early planted corn during the critical stages of reproduction in the heart of the main corn-growing regions of western Cordoba, southern Santa Fe, and northern Buenos Aires, limiting yield prospects.

“The same weather that struck Argentina also stressed corn yields in southern Brazil, particularly parts of Rio Grande do Sul and Santa Catarina. These states that produce almost half of Brazil’s first crop corn are now moving to the filling phase of the reproductive period. With reduced first-crop yields, 2020-21 corn production for Brazil is projected down 1 million tonnes this month (less than 1%) to a still-significant record-high of 109 million tonnes, 7 million tonnes ahead of last year.”

The European Confederation of Maize Production, CEPM, said in its Jan. 20 Corn Market report that between Jan. 8 and 15, “the Chicago March expiry price increased by $14 per tonne to $209 per tonne.”

“This strong increase is due to the publication of the USDA monthly report,” the CEPM said, noting that “this report revised the maize uses downward compared to December: (down) 2.5 million tonnes for ethanol to 126 million tonnes, which is still suffering from low fuel consumption, and (down) 2.5 million tonnes for exports to 65 million tonnes, as contracts have not yet materialized sufficiently in exports.

“These figures could have triggered a downward trend in prices, but the USDA has also revised US production downward, which was not expected by operators.”

For the 2021-22 crop year, in January and compared to 2019-20, Strategy Grains projects that European corn acreage will decrease by nearly 300,000 hectares to 8.62 million hectares, including 220,000 hectares in France (1.45 million hectares), in favor of wheat, the CEPM reported.