India’s production of wheat has broken records in recent years, while the country remains a major producer and the world’s biggest exporter of rice.

In its January Grain Market Report, the International Grains Council (IGC) forecast India’s total grains production in 2019-20 at 148.6 million tonnes, unchanged from its previous estimate of a month earlier and up from 142.7 million produced in 2018-19.

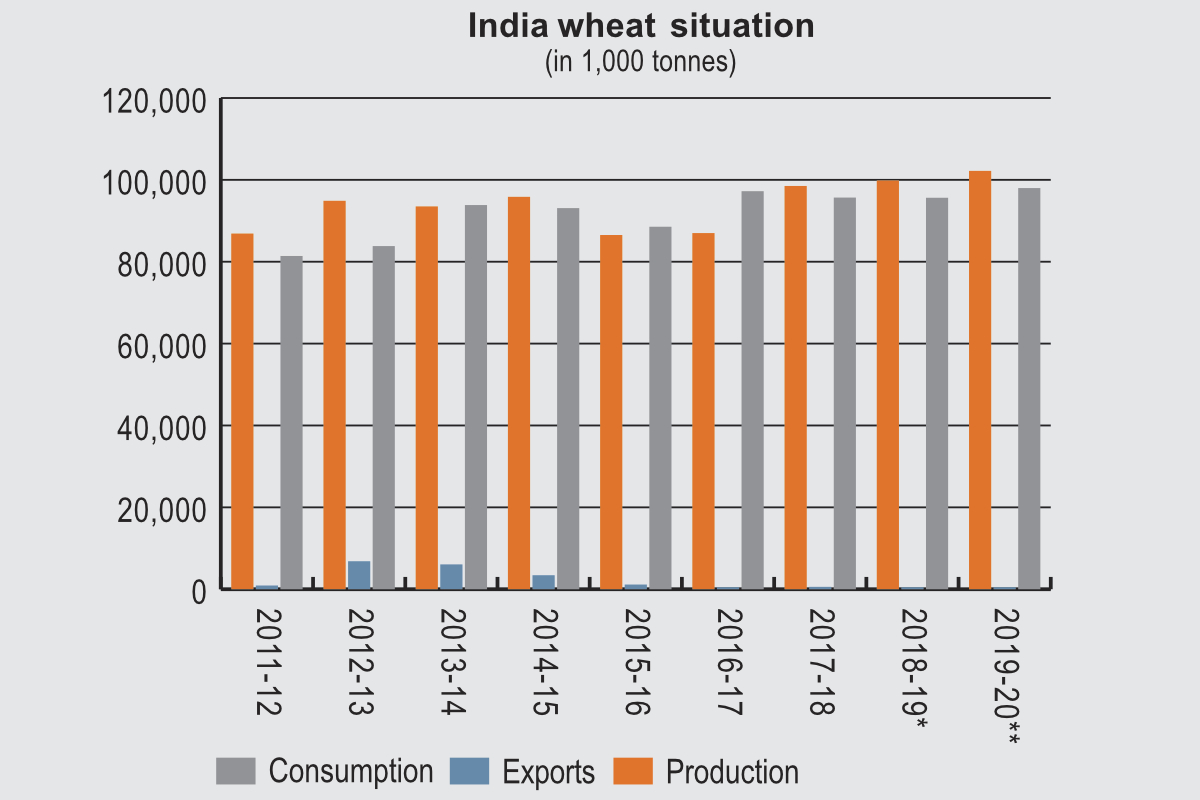

The country’s wheat production is put at 102.2 million tonnes, also unchanged from the previous month and up from 99.7 million the year before. India’s corn crop in 2019-20 is estimated at 28.4 million tonnes, another unrevised estimate, compared with 27.2 million in 2018-19. The country’s barley crop is put at 1.8 million tonnes, an unrevised estimate that is the same as the previous year’s production. The sorghum crop is put at 4.7 million tonnes, unrevised and up from 3.8 million the previous year.

India’s total grains imports in 2019-20 are put at an unrevised 700,000 tonnes, up from 300,000 the year before. Its total grains exports are put at an unrevised 1.1 million tonnes, compared with 1.2 million in 2018-19. Wheat imports are put at 100,000 tonnes, unrevised and with no figure given by the IGC for the previous year. Its exports of wheat are put at 400,000 tonnes, unrevised from a month earlier and down from 500,000 the year before. Barley exports are put at 100,000 tonnes, also unrevised, with no figure for the previous year. India is also forecast to export 60 million tonnes of sorghum in 2019-20, an unrevised figure that compares with 62 million the previous year.

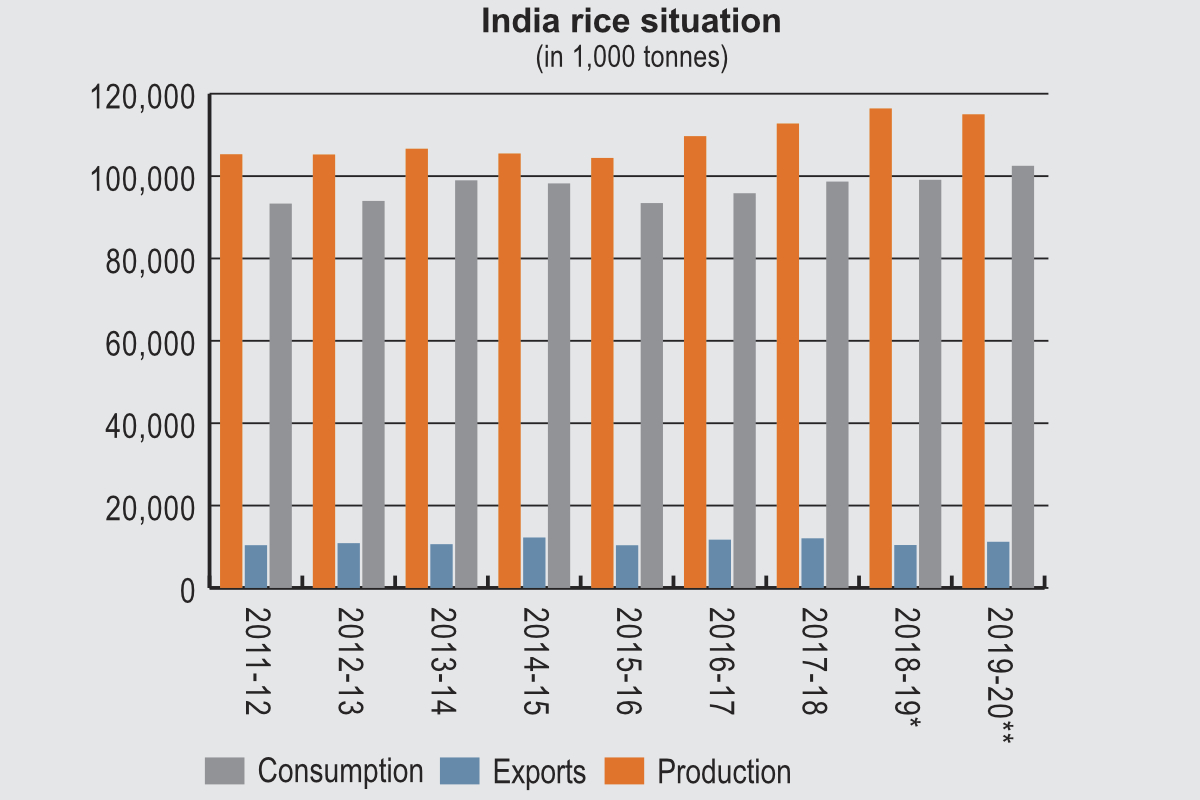

Rice production in India in 2019-20 is put at 115 million tonnes, unrevised from the previous report and down from 116.4 million the year before. India is the world’s leading exporter of rice at a forecast 10.4 million tonnes for 2019-20, revised down from the previous month’s figure of 11.2 million and up from 9.9 million in 2018-19.

The USDA attaché explained in an annual report on the grains sector dated March 29, 2019, that government policies on agriculture and food security have driven growth in wheat production over the last few decades.

“Acreage in recent years has been relatively stable at around 30 million hectares, as farmers prefer wheat to other crops in irrigated areas because of ‘assured’ returns,” the attaché said.

The government’s procurement program means that market prices during harvest are stable compared to other crops, while wheat productivity under irrigated conditions is also stable compared to other crops.

“While wheat yields in the irrigated northern states are comparable to other high yielding producers in the world, yields in other states have also been steadily increasing with the expansion in irrigation facilities and adoption of improved varieties and production technologies, resulting in an upward yield trajectory in recent years,” the attaché said.

However, the report also explains that “despite nearly a decade of bumper wheat harvests, Indian wheat cultivation faces future threats of diversion of acreage to non-agricultural use, soil degradation, and climate change.”

“India’s growing population and economy is creating significant pressure on agricultural land to support growing urbanization and infrastructure needs,” the report said. “Since most of the wheat area has assured ground/canal irrigation supplies, interest from urban developers and other non-agricultural businesses is leading to an increasing diversion of area dedicated to wheat cultivation adjacent to urban habitats.”

There are problems in northern India with over exploitation of ground water, a flood irrigation causing oil salinity and declining water tables, something that could force farmers to switch to less water intensive crops.

“Vulnerability of the wheat crop to climate change, particularly the threat of rising temperatures due to an ‘earlier-than-normal’ onset of summer (terminal heat) affecting the crop at the grain filling/maturity stages (March/April), is a major concern among researchers,” the attaché added.

Of 30 million hectares under wheat cultivation, about 10 million to 12 million are reported to be prone to terminal heat stress.

The attaché cited market sources as reporting that 55% to 60% of wheat is marketed by farmers, with the rest saved for personal food, feed and seed use. More than half of the wheat marketed is procured by the government under the minimum selling price program for distribution through the public distribution system and other food programs for sale on the open market to private millers.

“The balance of marketed wheat is procured directly by the private sector for milling, processing and other uses,” the report said.

The attaché forecast that in the near future, India is likely to continue to be an erratic participant in the international wheat market, importing wheat when domestic supplies are depressed or of particularly low quality and exporting wheat when international prices are favorable.

“However, India is expected to emerge as a small, but growing, consistent market for high-protein wheat imports for the growing bakery/confectionery industry and western-style fast food sector,” the report said. “The rapidly growing fast food and modernizing bakery/confectionery industries generate demand for specialty flours (used in pizzas and burger buns) that require different wheat classes that are not produced locally.

“Wheat is consumed at the household level, local restaurants, and eateries in the form of handmade breads called chapattis or rotis or parathas (unleavened flat bread) using atta (whole wheat flour) estimated at around 75% to 80% of total consumption. Some wheat is used for traditional processed products like raised breads, biscuits (cookies) and other bakery items (about 15%).”

The attaché described the organized milling sector as small with 1,250 to 1,300 medium to large flour mills with a total capacity of about 25 million tonnes a year (wheat equivalent) and put capacity utilization at 50% to 60%.

Rice and oilseeds

Rice remains the country’s most important staple food crop.

“With increasing pressure from urbanization and other high value crops, India’s rice acreage has plateaued at around 44 million hectares, in recent years,” the report said. “However, production shows steady increases on improving yields due to the new varieties, better agronomic practices, and expansion in irrigation facilities.”

Government programs have enabled productivity gains in the eastern and southern states, but the report pointed out that “India’s overall rice yields are still well below the world average, with wide variations in productivity among the major producing states and across the country.”

“Being one of the world’s fastest growing developing economies, experts report that India’s per capita consumption of rice has been stagnant in recent years,” the attaché said.

The government has expanded food security programs to ensure the supply of rice to the poorer parts of the population over the last decade.

“However, with the growing economy and expanding middle/upper class, consumers are increasingly replacing a ‘basic’ food staple like rice with higher protein and higher nutrition items such as pulses, meat, dairy, fruits, and vegetables,” the attaché said.

The government has procured around 30% to 35% of total rice production for food security programs in recent years.

According to a Dec. 4, 2019, update by the attaché on the oilseeds sector, Indian soybean production for 2019-20 will be 9 million tonnes, compared to 11 million the previous year, on “poor yield due to weather-induced stress during the peak reproductive and maturity stage.”

Biotechnology

In a Dec. 4, 2019, report on the development of biotechnology in India, the attaché indicated that India’s political environment continues to thwart the development of agricultural biotechnology.

“Bt cotton remains the only biotech crop approved for commercial cultivation,” it said. “Soy and canola oils derived from select GE soy and canola events are the only products derived from GE crops, animals or their byproducts approved for import.”