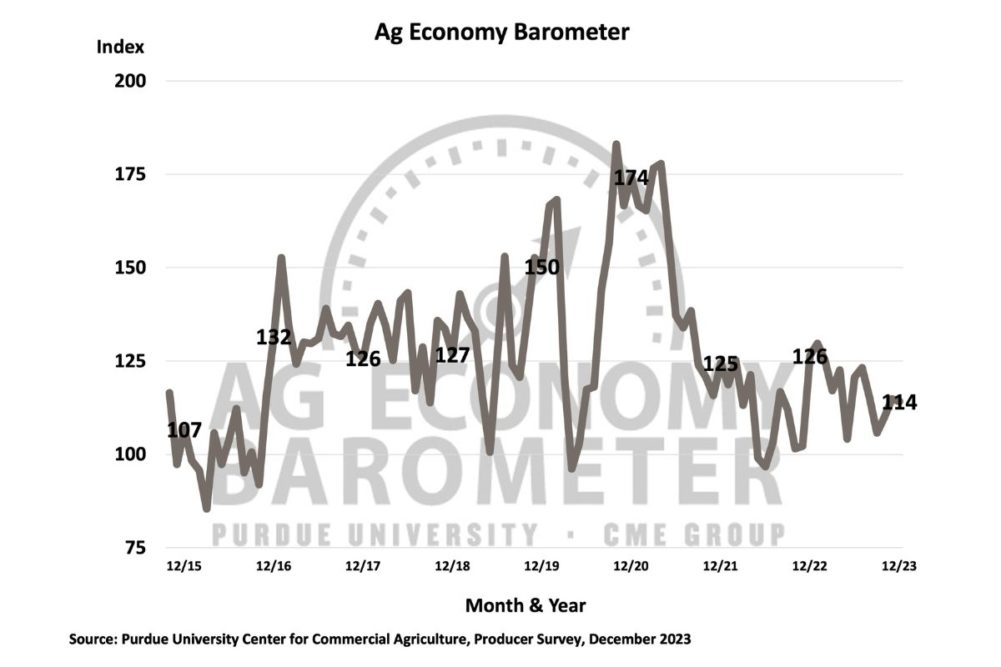

WEST LAFAYETTE, INDIANA, US — The latest report from the Purdue University/CME Group Ag Economy Barometer indicates that US farmers’ inflation expectations have subsided while overall producer sentiment changed little.

The December barometer recorded a reading of 114, just one point lower than in November. Both sub-indices of the barometer, the Index of Current Conditions and the Index of Future Expectations, mirrored this slight decline, settling one point below their respective November figures at 112 and 115. Notably, farmers’ inflation expectations for the upcoming year were markedly lower than those reported a year ago for 2023. This month’s Ag Economy Barometer survey was conducted from Dec. 4-8.

Farmers reported another improvement in their farms’ financial performance during the month of December. The Farm Financial Performance Index saw a 2-point increase compared to the previous month, marking a continued positive trend. Since late summer, the index has climbed 11 points, and at year-end, it was 21 points above the low point for 2023, which occurred in May.

“The shift in farmers’ perception of financial performance during the fall quarter corresponds with USDA’s (US Department of Agriculture’s) more optimistic 2023 farm income outlook released in late November, which was $10 billion higher than their previous forecast,” said James Mintert, the barometer’s principal investigator and director of Purdue University's Center for Commercial Agriculture.

The Farm Capital Investment Index reading of 43 was only one point above November’s, but it marked a 13-point increase compared to the same period last year. Respondents endorsing the notion that now is a favorable time for substantial investments in their farm operation cited “higher dealer inventories” and “strong cash flows” as key factors supporting this perspective. While the percentage of respondents selecting “strong cash flows” as a rationale for investment rebounded from the previous month, it remained less popular than in July and August. Conversely, in December, the percentage of producers citing “higher dealer inventories” as a primary motivation for investment was more than double the proportion who expressed a similar sentiment in July.

“High input costs continue to be concerning for US farmers, although a notable shift in concerns took place as 2023 unfolded,” Mintert said.

Farmers concerned about the risk of lower prices for crops and livestock increased from 16% of respondents in January to over one-fourth (26%) by December. Number three on the list of concerns for the upcoming year was “rising interest rates,” chosen by 24% of farmers in December’s survey.

Producers’ inflation expectations moderated, with 70% expecting inflation in 2024 to be less than 4%. By comparison, 50% of the producers anticipated an inflation rate of 6% or higher a year ago. When asked about interest rates, about one-third (34%) of respondents said they anticipate rates declining in 2024 while 22% expect no change in interest rates in the upcoming year.

Perspectives on farmland values weakened slightly in December compared to November. The Short-Term Farmland Value Index fell 4 points to a reading of 121, while the long-term index decreased by 2 points to 149. Compared to a year ago, the short-term index was down 3 points, while the long-term index was 9 points higher.

“The improvement in farmers’ interest rate expectations since late 2022 could help explain the year-to-year rise in farmers' long-term farmland value expectations,” Mintert stated.