WEST LAFAYETTE, INDIANA, US — Rising input costs and supply chain issues continue to be the No. 1 concern for US farmers, according to the monthly Ag Economy Barometer report released March 1 by Purdue University and the CME Group.

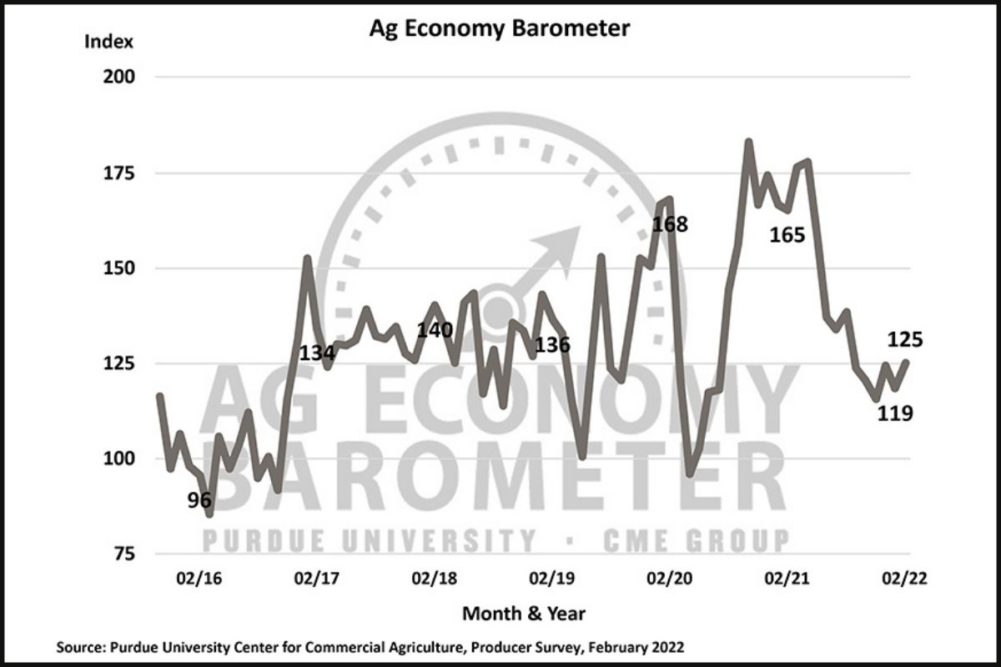

The latest report found that farmer sentiment rose 6 points to a reading of 125 in February, a mirror image of the previous month. The Index of Current Conditions was down 1 point to a reading of 132, while the Index of Future Expectations improved 10 points to a reading of 122.

The Ag Economy Barometer is calculated each month from 400 US agricultural producers’ responses to a telephone survey. This month’s survey was conducted between Feb. 14-18, 2022, just a few days prior to Russia’s invasion of Ukraine.

The Farm Financial Performance Index remained unchanged in February at a reading of 83. However, the sharp drop in the index, down 27% from late 2021 to 2022, indicates producers expect financial performance in 2022 to be worse than in 2021. The financial index is generated based upon producers’ responses to whether they expect their farm’s current financial performance to be better than, worse than or about the same as the previous year.

“These survey responses suggest that concerns about the spike in production costs and supply chain issues continue to mostly outweigh the impact of the commodity price rally that’s been underway this winter,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

Higher input costs have consistently been the No. 1 concern identified by farmers over the past six months, according to results from the Ag Economy Barometer survey. While a majority still consider input costs as their No. 1 concern (47%), it was followed by lower output prices (16%), environmental policy (13%), farm policy (9%), climate policy (8%), and COVID-19's impact (7%).

Tight machinery inventories continue to be a problem. In February, more than 40% of producers stated that low farm machinery inventories are holding back their investment plans. While plans for farm building and grain bin construction were more optimistic this month, 56% still said their plans for new construction are below the previous year.

About one-third of corn and soybean producers say they’ve had difficulty purchasing crop inputs from their suppliers. In a follow-up question posed to corn and soybean producers who said they experienced difficulty procuring inputs, herbicides are the most problematic input to source followed by fertilizer and farm machinery parts. To learn more about how crop producers are responding to surging fertilizer prices, corn producers were again asked if they plan to change their nitrogen fertilizer application rate in 2022 compared to the rate used in 2021. One-third of corn producers in this month’s survey said they plan to use a lower nitrogen application rate this year than in 2021, compared to 37% of corn producers who said they planned to reduce their nitrogen application rate when surveyed in January.

The full report is available at purdue.ag/agbarometer.