Worry over world grain stocks is being heightened by the realization that Brazil’s Safrinha corn is reproducing in a very limited moisture environment. The first 10 days in May are unlikely to provide much opportunity for improved rainfall or soil moisture, implying lower yields for the early crop.

Nearly 60% of Brazil’s corn was planted beyond the optimal planting date of Feb. 20 and nearly one-third of the crop was planted three to five weeks later than usual. Rising futures prices gave producers plenty of incentive for planting no matter how late it got, but now the proof is in the pudding and yields may be falling more than expected. Between 25% and 50% of the corn crop was silking and flowering at the end of April. Rain must fall significantly in the first half of May to give crops a chance to yield as well as possible given the late planting dates.

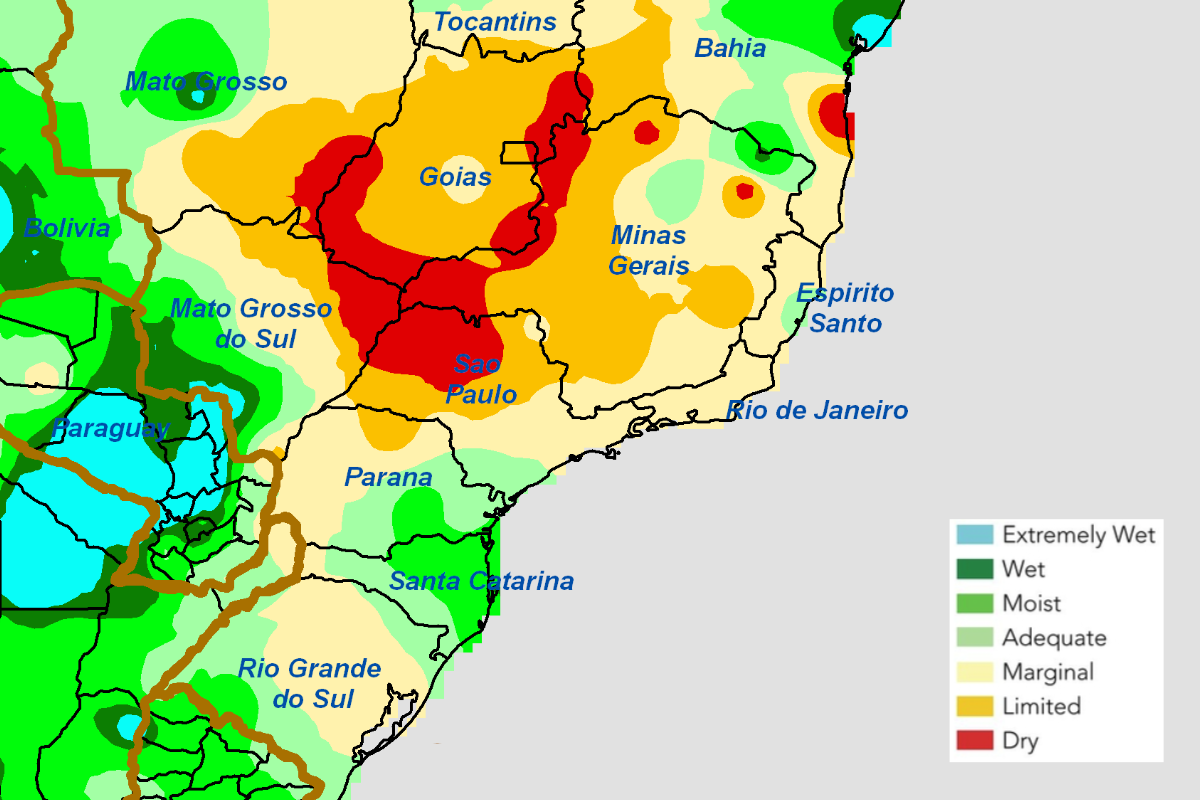

Brazil’s rainfall in April fell well below average in southern Safrinha corn areas, including Parana, São Paulo, eastern Mato Grosso do Sul, southern Goias, southwestern Minas Gerais and southeastern Mato Grosso. The limited rain was not a big deal as long as timely rain occurs in May. However, typically the dry season begins at the end of April and substantial rain in May is a rare occurrence.

The premature start to the dry season in some southern corn areas already has led to short and very short top and subsoil moisture. The success of second season crops in Brazil often is determined by a fully saturated soil column when the monsoon season ends. That way Safrinha crops can coast on subsoil moisture through the reproductive and filling stages of development. That cushion of moisture is absent this year and corn needs that moisture now more than ever.

Northern Safrinha crop areas have not been nearly as dry, and crops still have good production potential in northern and western Mato Grosso and western and some central Mato Grosso do Sul production areas. Subsoil moisture is sufficient in these areas to carry crop development into the first half of May, and farmers are hoping for a few bouts of light rain between now and then to protect subsoil moisture. Temperatures may briefly rise above average, causing faster moisture losses and greater crop stress. Some temporary cooling may occur in the second week of May, and the frontal system bringing the cooler conditions could generate a little rainfall. The moisture may slow down the deterioration of corn conditions, but without a general soaking of rain, any relief is expected to be temporary and downward production potentials will resume after a few days of net drying.

Brazil’s drying bias is not just affecting corn, but its sugarcane, coffee and cocoa crops as well. However, most of these soft agricultural commodity crops have matured enough that the impact on production will be low. Sugarcane has had a tough year with seasonal rainfall four to six weeks later than usual and then periods of dryness continued to come and go during the heart of the summer season. As a result, Brazil’s sugarcane tonnage will be down, but the sucrose levels may be high in the cane that is harvested.

The risk to coffee because of dryness will not be on this year’s crop, which is maturing and getting ready for harvest, but it could impact next year’s crop if seasonal rainfall is delayed. The extra weeks of dry-biased weather in coffee areas will have soil moisture more depleted than usual by September when seasonal rains usually resume, and if they are late, trees could become stressed enough to perform poorly in the Southern Hemisphere spring.

Brazil’s dryness in corn production areas is more serious than that of the coffee or sugarcane crops primarily because of corn’s higher demand in world trade and the already low ending stocks being reported in the United States. A smaller Brazil crop will put more pressure on the US crop in 2021, and there is quite a bit of speculation over the fate of the US crop weather this summer.

Drought in North America

Drought continues to dominate a large part of North America stretching from Mexico through the western half of the United States to portions of Canada’s Prairies. May is a critical month for precipitation in the central Plains for hard red winter wheat reproduction and filling and for the planting and establishment of spring and summer grains and oilseeds in the northern Plains and Canada’s Prairies. May likely will be extremely critical in determining the fate of small grains in the United States and Canada. Continued drought during the month would delay planting and leave crops poorly established and vulnerable to lower yields without perfect conditions in June and July.

Corn and soybeans have been produced more abundantly in recent years across the northeastern US Plains and upper Midwest as well as in Manitoba and Saskatchewan, Canada. Many of these areas have been drier biased in recent months. Getting a lasting bout of relief from dryness in the early spring is much easier than getting it in late spring or summer, and some areas in Manitoba, North Dakota and Saskatchewan have reported well below-average rainfall since last autumn. For some areas in the Prairies, dryness has lasted four years with 2016 the last wetter-than-usual growing season. Needless to say, substantial rain needs to fall.

World Weather, Inc. expects rainfall in the northern Plains and Canada’s Prairies to increase during May with some of it to linger into June. The moisture will not be sufficient to fix low subsoil moisture, but it will give farmers support for planting their 2021 crops. Sufficient timeliness in rainfall during May and early June also will support planting, emergence and establishment. However, the odds are relatively high that dryness will be returning to the northern US Plains, Canada’s southern Prairies and a part of the upper US Midwest this summer, which may lead to crop moisture stress during reproduction — similar to that which is expected in Brazil over the next few weeks. If the forecast is correct, a smaller US crop may be on the horizon.

A full-blown, wall-to-wall drought like that of 2012 is not likely or expected by World Weather, Inc. However, regional dryness will dig into some of the production potential, which may reduce production enough to tighten world ending stocks a little more. Farmers are expected to take advantage of high futures prices and cash in on whatever crop is produced no matter how small, but the consumer will come up on the short end of the stick with a further rise in food prices.

In the meantime, food companies need to not only be frugal with their expenses this year, but they could be facing multiple years of shorter supplies and higher prices, making profitability a greater challenge. Efforts should be taken now to prepare for this year’s shorter crops and the potential of additional trouble in 2022 as La Niña returns while soil conditions are still drier than usual.

Drew Lerner is senior agricultural meteorologist with World Weather, Inc. He may be reached at worldweather@bizkc.rr.com. World Weather, Inc. forecasts and comments pertaining to present, past and future weather conditions included in this report constitute the corporation’s judgment as of the date of this report and are subject to change without notice.