It has been 20 years since George Clooney and Mark Wahlberg took to the high seas in the “The Perfect Storm.” The movie, based on the book by Sebastian Junger of the same name, told the true story of the Andrea Gail, which set sail from Gloucester, Massachusetts, US, on the eastern seaboard of the United States, in the fall of 1991 and headed for the fishing grounds of the North Atlantic.

Two weeks later, to quote the trailer, “an event took place that had never occurred in recorded history.”

Here in 2020 we face another perfect storm, one induced by the global spread of the coronavirus, which has wrought economic, political and social havoc. Everything about 2020 ticks the “unprecedented” box. Yet even from within the maelstrom, it is difficult to identify a market that is facing a more mountainous set of challenges then dry bulk shipping.

This is a sector that always has lurched from highs to lows and back again, but even by historical standards 2020 has been something of a disaster, for ship owners at least.

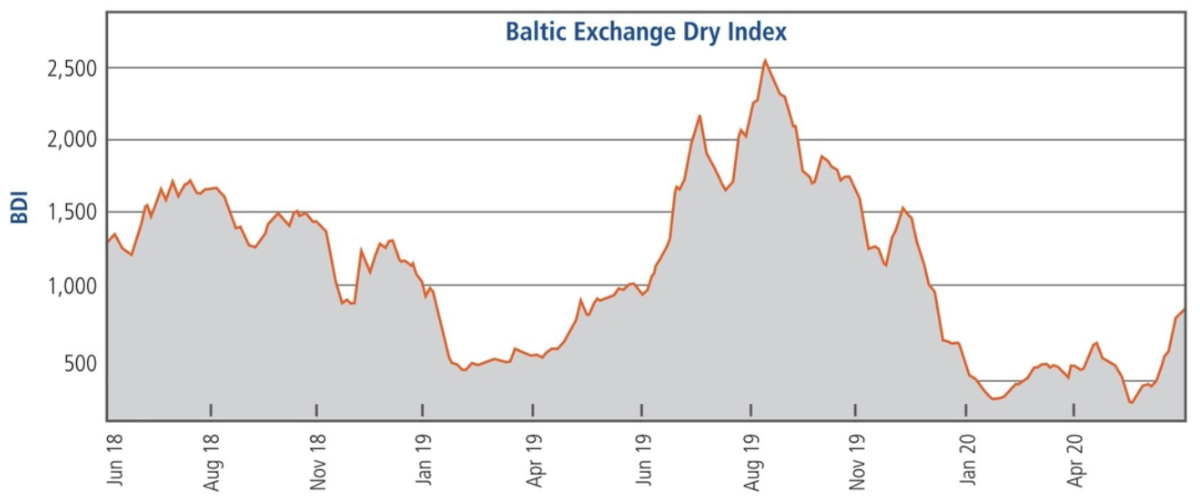

The Baltic Dry Index (BDI), for example, has not been above 1,000 all year and dipped under 400 during May, perilously close to the all-time low of 290 points recorded in February 2016 (see BDI chart, 1985-now). Only at the start of June did the BDI start to nudge cautiously back up, but still only to levels that will leave vessel owners and operators wondering how they can avoid heavy losses this year.

Grain shipment prices slide

For the smaller bulk carrier markets used by grain shippers, a bottom-hugging BDI has meant an extended period of lower prices for supramax and handysize vessels this year. The Baltic Handysize Index (BHSI) started the year at 465 points but spent most of April and May under the 300-mark, climbing to a lowly 304 only on June 9.

The Baltic Panamax Index (BPI) reached 799 points on June 9, up from less than 600 in mid-May, but down from 1,003 points at the start of the year. Indeed, from Jan. 2 until mid-June, the BPI was only above the 1,000-point threshold from March 5-13.

The slump recorded in Baltic Exchange indexes has resulted in lower freight costs for grain shippers as recorded by the International Grains Council’s (IGC) Grains and Oilseeds Freight Index.

Despite a five-point jump at the start of June, on June 9 the Index read just 83, down 26% compared to a year earlier. On the same day the IGC’s Brazil, Black Sea and USA sub-indexes were down 24%, 48% and 25%, respectively, year-on-year.

The COVID-19 effect

Of course, the main reason for the obliteration of bulk shipping prices has been the spread of the coronavirus (COVID-19) and consequent global lockdowns. The fight against COVID-19 has suffocated demand for most commodities and much else besides. While Europe and North America are now easing pandemic containment regimes and China is starting to implement policies that could provide significant stimulus, both emerging and advanced economies have been seriously shaken in recent months and are hurtling into recession. The World Bank now expects global gross domestic product to shrink 5.2% this year, which would make it the fourth worst recession of the past 150 years after 1914, 1930 to 1932 and 1945 to 1946.

Rahul Sharan, lead research analyst at Drewry, told World Grain the current situation was “unprecedented.” He added, “I could have never imagined something like this could ever happen to the world when almost all countries had to get locked down.”

Peter Sand, chief shipping analyst at BIMCO, said the current economic situation is posing previously unimagined challenges for shipping.

“Have we ever seen a market like this? I don’t think so,” he said. “The pace of the decline in economic terms is scary. And we have not really seen the end of it yet, not even in China.

“The movements of the Baltic Dry Index in 2020, hovering at unusually low levels in June, underscores just how challenged the market is.”

The demand effect

Maritime Strategies International (MSI) said the grains trade has provided pockets of support to bulker demand this year, particularly for panamax and supramax vessels, with Brazilian soybeans exports reaching a record in April at 16.3 million tonnes, for example. However, a mixture of seasonal factors and protectionist measures in the Former Soviet Union are expected to see grains volumes decline during the Northern Hemisphere’s summer months.

Dry bulk shipping costs for grain shippers will, of course, be heavily influenced by the supply-demand balance for vessels across the market, particularly demand for the largest vessels in the global fleet. On the demand side of the equation, much will depend on stimulus policies, especially in China, the world’s leading importer of coal and iron ore.

In early June there were some signals from the capesize market that shipping costs for all vessels could be dragged up by rising coal shipments and, especially, a return to the iron ore market by Chinese steelmakers. Whether this would last was unclear, with some analysts insistent that the global economic situation would only support a short-term capesize bull run, but others more optimistic. Time will tell.

Growing vessel supply

Dry bulk shipping’s annus horribilis is not a purely demand-side story. As MSI noted, strong supply growth is just as important, not least because disruptions at Chinese shipyards due to earlier COVID-19 shutdowns have now eased.

This saw 46 new bulkers delivered in April, 21 of which were built in China.

“The disruptions at scrap yards, on the other hand, have only just begun,” the analyst said. “Only one vessel was scrapped in April as Bangladesh, India and Pakistan all shut their doors to vessel demolitions. With such a poor outlook for earnings, we expect there will be a spike in scrapping when breakers reopen, but with a relatively strong near-term orderbook, fleet growth at an annualized 3% will do little to help market balances. We expect layups to increase.”

A clooney denouement?

Spoiler alert! “The Perfect Storm” does not end well for the protagonists, who are overcome by the forces of nature. The dry bulk shipping sector also is being buffeted from all sides, mostly by economic forces beyond its control.

Certainly, growing supply and bearish demand is not a good equation for dry bulk shipping companies. And responsible shippers will take no joy that their freight partners are struggling — increased volatility and counterparty risk is, after all, good for no one. Much depends on whether the COVID-19 pandemic is set to wreak further economic destruction or the worst is now past. Certainly, a second outbreak and more shutdowns later in the year will be good for no one.

In 2021, the World Bank expects the global economy to bounce-back with growth of 4.2%, although it warns this is only a provisional reading and the outlook will be dictated by the pandemic.

“This is the first recession since 1870 triggered solely by a pandemic, and it continues to manifest itself,” said Ceyla Pazarbasioglu, the vice president of equitable growth, finance and institutions at the World Bank. “Given this uncertainty, further downgrades to the outlook are very likely.”

In the near term, China could provide stimulus, although “compared to the 2009-2010 recovery the effect could be seen as muted,” Sand said. Grains, he said, could be the “swing factor” depending on harvesting in key regions.

“Volumes may not change much, but distance could, and that would benefit the market,” he added.

Bears over bulls

Yet outweighing the positives, Sand believes macroeconomics are against vessel owners.

“Above all, globalization and trade relations are under attack and relations (between the United States and China have) further soured under COVID-19,” he said. “Both factors are reducing demand for shipping.”

As a result, he views the outlook for the dry bulk market from a vessel owner’s perspective as decidedly “bleak,” with low freight and charter rates likely to prevail for an extended period, not least because BIMCO forecasts dry bulk fleet growth of 3% this year while the demand outlook remains tepid.

“The dry bulk market depends on global economic growth and with the current prospect of declining demand in 2020, the dry bulk outlook remains lackluster for the rest of the year,” he told World Grain. “We expect rates for all dry bulk sectors to trend lower in 2020 from last year. Demand is falling at about the same pace as in 2009. But one of the differences this time around is that the balance is far worse going into 2020 than when we headed into 2009.

“Gradually recovering at a slow pace is not good for any sector. All work done to reduce the fleet will be effectful, but who will take responsibility and cut capacity?”

Sharan is more optimistic.

“As the economic activity comes back slowly in Asia and it will eventually come back to normal in other parts of the world, despite the continued threat, I think we should see a better shipping market in 2021,” he said. “I am expecting a sharp rebound. I still think rates should rebound in 2021.”

Michael King is a multi-award-winning journalist as well as a shipping and logistics consultant. He also supplies an array of corporate services - www.mkingassociates.com. For more information, email mikeking121@gmail.com.

Follow our breaking news coverage of the coronavirus/COVID-19 situation.