WEST LAFAYETTE, INDIANA, US — Sentiment among US agricultural producers declined sharply in May as crop prices continued to weaken, according to a report released on June 6.

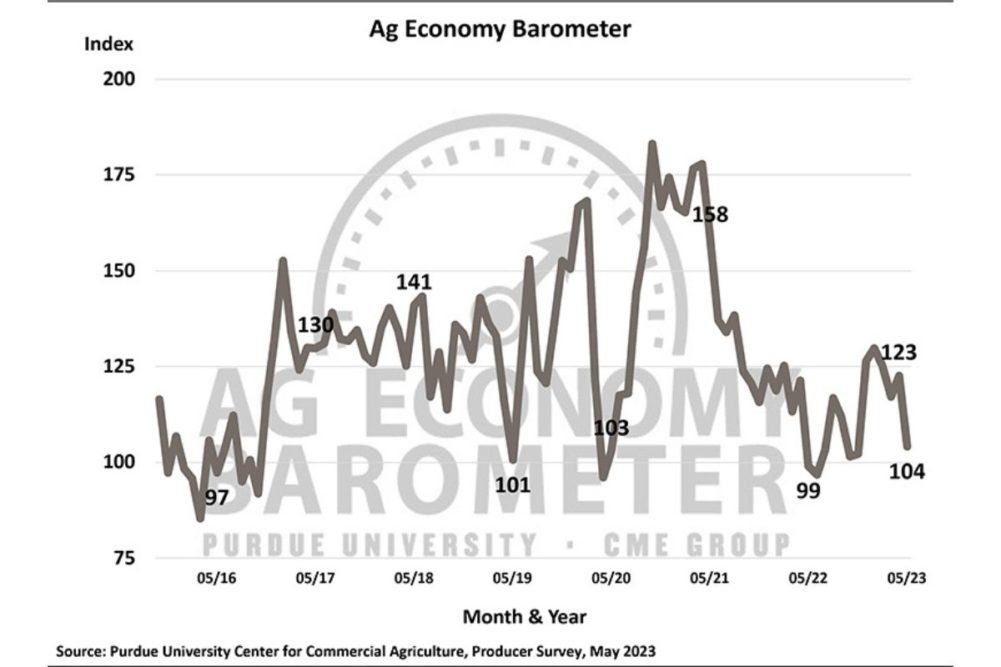

The Purdue University/CME Group Ag Economy Barometer, calculated each month from 400 US producers’ responses to a telephone survey, declined 19 points to a reading of 104 in May, its lowest level since July 2022.

The Index of Future Expectations was down 22 points to a reading of 98 in May, while the Index of Current Conditions was down 13 points to a reading of 116. This month’s lower sentiment was fueled by drops in both of the barometer’s sub-indices and likely triggered by weakened crop prices, according to the barometer’s principal investigator, Jim Mintert. In mid-May, Eastern Corn Belt fall delivery bids for corn fell over 50¢ per bushel (10%) and soybean bids declined over $1 per bushel (8%), while new crop June/July delivery wheat bids declined nearly 50¢ per bushel (8%), all compared to bids available in mid-April when last month’s barometer survey was conducted.

“Producers are feeling the squeeze from weakened crop prices, which has reduced their expectations for strong financial performance in the coming year,” said Mintert, director of Purdue University’s Center for Commercial Agriculture.

The Farm Financial Performance Index was impacted by lower sentiment, dropping 17 points to a reading of 76 in May. Crop price weakness, uncertainty related to US bank failures and rising interest rates were likely key factors behind the decline. In May, 38% of respondents said they expect weaker financial performance for their farm this year, compared to just 23% who felt that way in April.

Higher input cost remains the top concern among producers in the year ahead. However, concern over the risk of lower crop and/or livestock prices is growing. In May, 26% of respondents chose lower output prices as their top concern compared with just 8% of respondents who felt that way in September 2022. Meanwhile, 59% of producers said they expect interest rates to rise during the upcoming year and 22% of respondents chose it as a top concern for their farm in the next 12 months.

The Farm Capital Investment Index was also lower, down six points to a reading of 37 in May. The survey noted that more than three-fourths of respondents continue to feel now is a bad time for large investments. Among those who feel now is a bad time, two-thirds cited rising interest rates and increased prices for machinery and new construction as key reasons.

With farm bill discussions ongoing, the May survey asked respondents what title in the upcoming legislation will be most important to their farming operation. Nearly half (48%) of producers said the Crop Insurance Title will be the most important aspect of a new farm bill to their farms, followed by the Commodity Title, chosen by 25% of respondents.

In a follow-up question, corn and soybean growers were asked what change, if any, they expect to see to the Price Loss Coverage (PLC) reference prices in a new farm bill. Close to half (45%) of corn and soybean growers said they expect Congress to establish higher reference prices for both crops, with very few (10% and 13%) expecting lower reference prices for soybeans and corn, respectively.