WEST LAFAYETTE, INDIANA, US — Faced with higher input costs and rising inflation, US farmers are feeling less certain about current and future conditions.

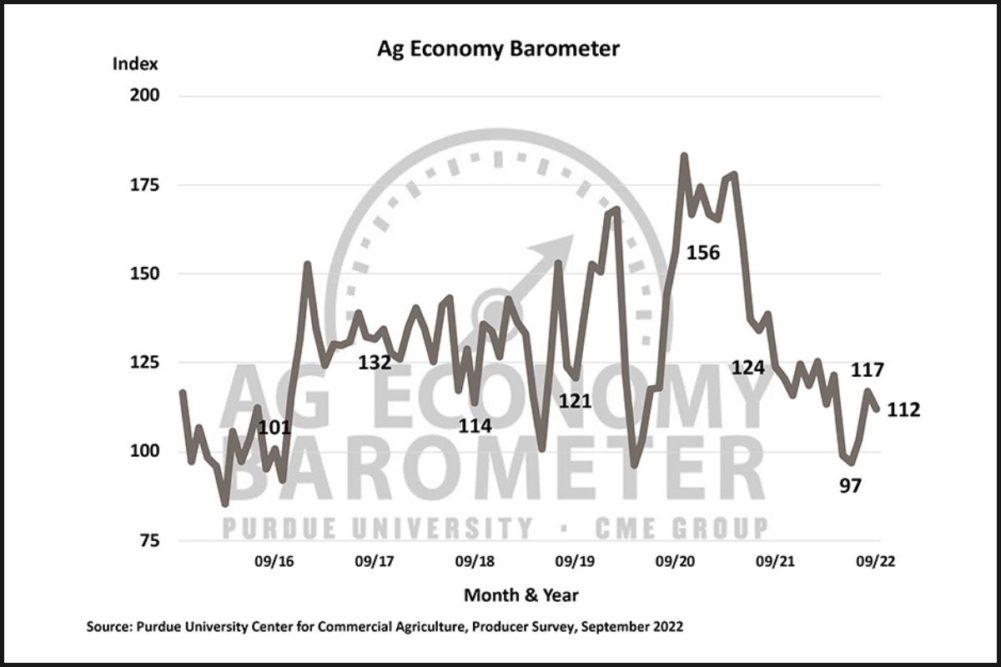

The farmer sentiment index dropped five points to a reading of 112 in September, according to the Purdue University/CME Group Ag Economy Barometer. The barometer is calculated each month from 400 US agricultural producers’ responses to a telephone survey, which was conducted this month between Sept. 19-23.

“Concerns about input costs and, in some cases, availability are key factors behind the relative weakness in this month’s farmer sentiment,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “However, a growing number of producers are also concerned about the impact of rising interest rates on their farm operations.”

Higher input costs remain the No. 1 concern among survey respondents. In September, 44% of respondents chose “higher input costs” as their No. 1 concern, while 23% chose “rising interest rates,” and 14% chose “availability of inputs.” When asked to look ahead to 2023, the largest share (38%) of producers expect input prices to rise from 1% to 9%, compared to 2022 prices. Meanwhile, nearly a fourth (24%) of producers expect input prices to rise from 10% to 19%, and 9% of survey respondents said they expect an input price rise of 20% or more.

The Farm Capital Investment Index declined to a record low of 31 in September, as producers continue to indicate now is not a “good time” to make large investments in their farming operations. For the third month in a row, producers overwhelmingly (46%) said it was due to increasing prices for farm machinery and new construction; however, 21% indicated that “rising interest rates” were a primary reason, up from 14% who cited interest rates back in August.

Despite that negative perspective, fewer producers plan to reduce their farm machinery purchases. Since peaking in March 2022 at 62%, the share of producers who plan to reduce their machinery purchases compared to a year earlier has been declining, dipping to 47% in September. Their plans for farm building purchases tell a similar story. Since the March 2022 high of 68%, producers who planned to reduce their building and grain bin purchases has fallen to 56% in September.