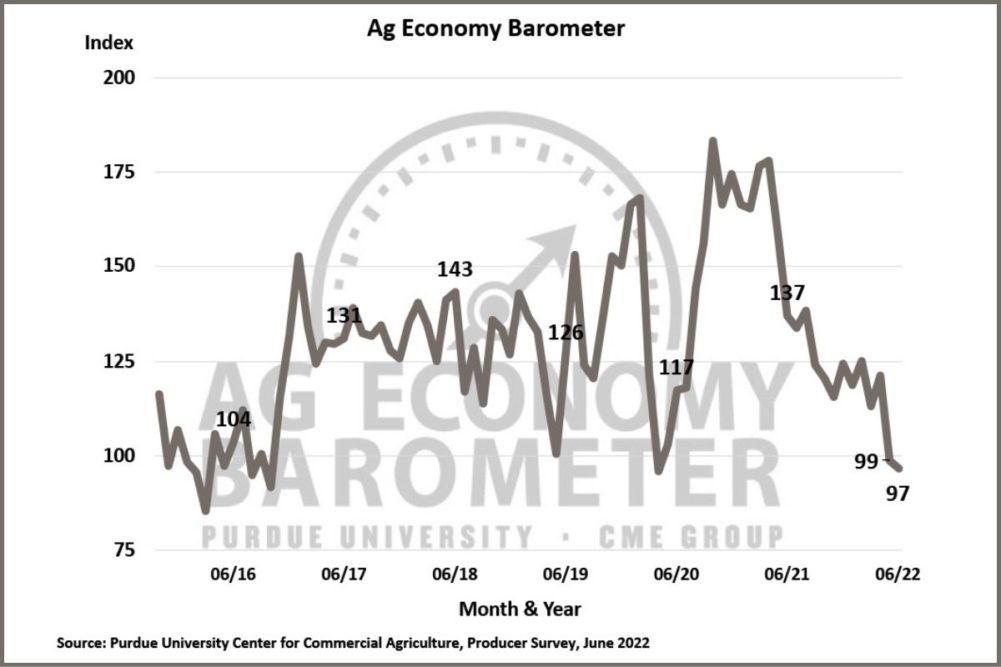

WEST LAFAYETTE, INDIANA, US — While farmers in the United States are slightly more optimistic about current conditions, rising costs and future concerns weighed heavily on their minds, and the Purdue University-CME Group Ag Economy Barometer slipped two more points in June to 97.

The survey’s Index of Future Expectations declined 5 points to a reading of 96, the lowest level since October 2016. Rising costs and uncertainty about the future continue to be a drag on farmer sentiment. This month 51% of survey respondents said they expect their farms to be worse off financially a year from now, the most negative response received to this question since data collection began in 2015.

The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from June 13-17, 2022.

“Rising input costs and uncertainty about the future continue to weigh on farmer sentiment. One out of five crop producers in the June survey said they intend to change their crop mix in 2023 with the largest percentage of respondents planning a move towards more soybean production,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The top concerns for producers in the upcoming year continue to be input prices (43%), followed by input availability (21%), government policies (18%), and lower output prices (17%). Looking ahead to 2023, a majority of farmers expect to see another round of large input cost increases with 63% of producers expecting higher costs in 2023, on top of the large increases experienced in 2022.

Given ongoing concerns about world food grain supplies, this month’s survey again included several questions focused on crop producers’ production plans for the upcoming year. Among the farmers surveyed who planted winter wheat in fall 2021, one out of four (24%) said they plan to increase their winter wheat acreage this fall. Among crop producers who did not plant winter wheat last fall, 14% responded that they intend to plant some winter wheat this fall. Responses to both questions point to a rise in wheat acreage in response to strong wheat prices.

Although producers said they expect their farm’s financial condition to be worse in June 2023 compared to June 2022, the Farm Financial Performance Index improved slightly to a reading of 83 compared to 81 in May. Responses received to the Farm Financial Performance Index question are primarily reflective of income expectations for 2022.

The question that asks producers about financial conditions a year from now brings into play concerns about the ongoing escalation in production costs, in addition to concerns about commodity price volatility, which could lead to a production cost/income squeeze taking place in 2023. Even with the small rise in the financial performance index, it remained one of the index’s lowest readings of the last two years.

This month's survey also asked farmers who planted corn or soybeans in 2022 about their expectations for farmland cash rental rates in 2023. Over half (52%) of respondents said they expect cash rental rates to rise next year. Of those who expect rates to rise, 8 out of 10 respondents said they expect rates to rise 5% or more, while 4 out of 10 said they expect rental rates to rise by 10% or more in 2023.

The Farm Capital Investment Index remained at its record low of 35 for the second month in a row. Producers continue to view this as not being a good time to make large investments in their farm operation because of problems they’ve experienced in the supply chain. For the second month in a row, 50% of producers in this month’s survey said that tight machinery inventories impacted their farm machinery purchase plans.