KANSAS CITY, MISSOURI, US — Whether they do business directly in the Black Sea region or not, grain equipment suppliers attending the 2022 GEAPS Exchange are feeling the impacts of Russia’s invasion of Ukraine.

Projects in the Black Sea region have come to a halt or are in limbo, and equipment and facilities have been severely damaged. Outside of the region, the war is further complicating supply chain issues and rising steel prices. GEAPS Exchange continues today in Kansas City, Missouri, US.

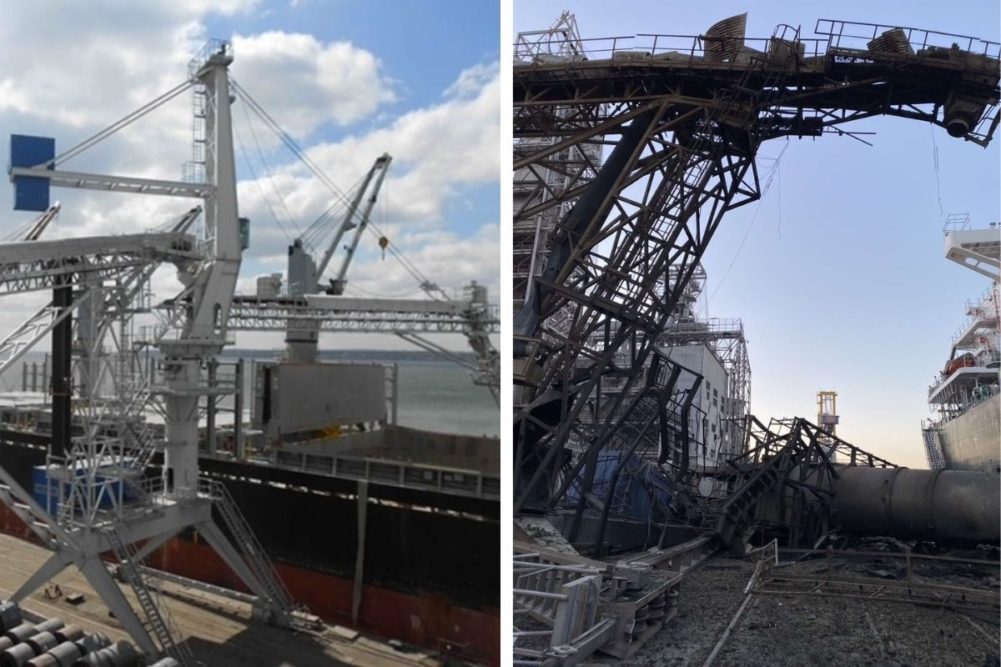

Neuero, a ship loading/unloading company based in Melle, Germany, said a ship loader it supplied at a port in Ukraine was bombed in the conflict. The company has active contracts in Ukraine and Russia. The project in Ukraine was 40% delivered and now it’s just laying in the yard, said Andreas Hindenburg, executive director sales and projects.

“We have a project in Russia that we will deliver next month,” he said, but the rapidly developing situation, including transportation issues, makes it uncertain whether it can be delivered.

Delivery issues exist in other parts of the world as well, said Jack Fox, sales manager for Neuero. Two unloaders destined for Canada are mostly complete and nearly ready to ship.

“Shipping costs have almost doubled,” he said. “These are being shipped completely built so it’s a big chunk of money. We had an unloader in the Philippines that lost some electrical components in a typhoon. You can’t get them. What used to be a four- or five-week delivery is now six months.”

The immediate situation right now is the war in Ukraine, but challenges remain from the pandemic.

“We had two whammies at the same time,” Fox said. “One was starting to get better we thought, and then the war starts.”

The Black Sea has been a strong market for Behlen, which supplied 250 bins with 53 million bushels of storage at Ukrainian ports and inland, said Kirk Nelson, sales manager international. It also has bins at three or four Russian ports.

Nelson said he doesn’t know of any damage for certain but said there were Behlen bins not far from the Neuero ship loader that was hit.

“It’s been two to three years since our last shipment to Russia,” he said. “Our last shipment to Ukraine was toward the beginning of COVID. When logistics were falling apart, we had bins strung out from Nebraska to Odessa, Ukraine. They ended up all getting there. My guess is they got assembled last year, but I’ve not heard for certain.”

A dealer in Ukraine that Behlen has partnered with for 15 years is trying to keep their people busy, looking for work in Africa and the Middle East.

“They’re trying to figure out how to keep the team together, the engineering staff and maybe the service staff as well,” Nelson said.

Several major projects in the region are on hold, said Travys Woodside, vice president of international sales at Chief. Chief has sales representatives in Ukraine and Russia.

“Overall, it is just completely shut down,” he said. “I know there is still a want and a willingness to do business, but when you look at the financial implications, the sanctions and everything else, it’s almost impossible.”

Chief used to do more business in the region, about 30% of its sales, but in the last few years the pace has slowed as European manufacturers have grown.

Demand overall is strong as some of the COVID issues start resolving but supply chain problems remain, with increased lead times for products that never had an issue in the past.

“Decisions are being made that were being held before; business volumes are certainly indicative of that,” Woodside said. “Supply chain is still a challenge. The challenges never stop, especially the last couple of years.”

Steel prices continue to be a challenge, said Scott Rysdon, chief executive officer of Sioux Steel. Prices went up and were starting to come back down, and then last week had the largest increase in 10 years. Cold rolled steel increased 19% and galvanized product went up 9%.

“I think we’re going to see a few more increases there, but I don’t believe it is going to be like it was this last week,” he said. “We’ll go back to 2% to 3% and then top out in a month or two. It will probably stay like that the rest of the year. There’s too much material already in the pipeline.”

Demand is strong, he said, but lead times continue to be an issue. Adding SCAFCO to the business, which was announced last week, will help ensure they have enough capacity to handle everyone’s needs, Rysdon said.

AGI also is experiencing strong demand and supply chain issues, said Mike Spillum, Hi Roller AGI, sales and marketing manager. The company also has a few projects in the Black Sea region that are in limbo right now.

“We have a couple of salespeople who live in Ukraine and are sticking around,” he said. “They are safe so far.”

The company is so diversified around the world that the Black Sea area is a very small portion of AGI’s overall business.

“You hate to lose any customer; it’s a great market, but it’s still a smaller piece of our whole picture,” Spillum said. “Right now, we’re more worried about the people than the business. They’ve got bigger problems than us not shipping a product over there.”