KANSAS CITY, MISSOURI, US — Traders of hard red winter wheat said rail performance has improved in recent weeks and were hopeful more equipment would soon be placed for sale in online auctions.

Railroad performance was sub-par during the fourth quarter. Union Pacific railroad told the Wall Street Journal it had miscalculated the effects on crews from COVID-19 infections and exposures amid a general US labor shortage.

“I look at that and I think, ‘Shame on us,’” Lance Fritz, chief executive officer of Union Pacific, said during a recent quarterly earnings call. “That’s a risk factor that we did not adequately plan for.”

In the first two weeks of January, traders reported more cars were being placed at western origins. Still, “it’s never enough to handle demand,” a veteran trader noted at the time. By the third week of 2022, rail performance had improved even further. Shippers and millers were encouraged by a hefty number of cars delivered to origins for loading.

Grain traders were told to expect cars for sale at auction either Jan. 31 or Feb. 7. As many as 500 cars per period were expected for April-June, “maybe even March-April-May,” another trader said.

More equipment availability and timelier placement of ordered cars had some in the market expecting an uptick in forward contracting of hard red winter wheat, or at least a jump in cars loaded for immediate sale.

“We’ve come down a dollar, which is rare; Kansas City basis moves more often are measured in penny moves rather than dollars,” the trader told Milling & Baking News, a sister publication of World Grain.

Rail activity

US weekly rail traffic in the week ended Jan. 15 totaled 493,617 carloads and intermodal units, down 7% compared with the same week in 2021, the Association of American Railroads said. That total comprised 233,647 carloads, up 0.5% compared with the same week last year and 259,970 containers and trailers, down 12% compared to 2021.

Coal, chemicals and nonmetallic minerals were the only three carload commodity groups to post a year-over-year increase for the week. US grain carloads in the week totaled 24,344, down 3,196 carloads, or 11%, from the same week in 2021, bringing total grain carloads for the first two weeks of 2022 to 46,296 for a weekly average of 23,148, down 16% compared with the first two weeks of 2021.

Canadian weekly rail traffic in the week ended Jan. 15 totaled 68,016 carloads, down 21% from the same week in 2021, and 64,393 intermodal units, down 13%. Petroleum and petroleum products was the sole commodity group to post an increase. For the first two weeks of 2022, Canadian railroads reported cumulative rail traffic volume of 249,567 carloads, containers and trailers, down 20%. Canadian grain carloads in the week totaled 5,084, down 54% from the same week a year ago, bringing the total for the first two weeks of this year to 11,344 carloads for an average of 5,672 per week, down 44% from the first two weeks of 2021.

Mexican weekly rail traffic in the week ended Jan. 15 totaled 22,022 carloads for the week, down 3% compared with the same week last year, and 15,299 intermodal units, down 4%. Cumulative volume on Mexican railroads for the first two weeks of 2022 was 66,710 carloads and intermodal containers and trailers, down 8% from the same point last year. Mexican grain carloads in the week totaled 1,886, down 23% from the same week in 2021, bringing the 2022 total to 3,162 for an average of 1,581 per week, down 31% from the same period last year.

North American rail volume for the week on 12 reporting US, Canadian and Mexican railroads totaled 323,685 carloads, down 5% compared with the same week last year, and 339,662 intermodal units, down 12% compared with last year. Total combined weekly rail traffic in North America was 663,347 carloads and intermodal units, down 9%. North American rail volume for the first two weeks of 2022 was 1,250,655 carloads and intermodal units, down 13% compared with 2021. North American grain carloads totaled 31,314, down 24% from the same week last year, bringing the total in 2022 to 60,802 for an average of 30,401 per week, down 24% from the first two weeks of 2021.

Rail prices

The average January shuttle secondary railcar bid-offer per car was $1,588 above tariff in the week ended Jan. 13, down $1,171 from the previous week and $1,113 higher than the same week in 2021, the USDA’s Agricultural Marketing Service said after appraising data from James B. Joiner Co. and Tradewest Brokerage Co. There were no non-shuttle bids or offer that week, the AMS said.

Barge activity

Freezing temperatures have slowed shipping on several US rivers that serve as vital shipping lanes, the USDA said in its latest weekly Grain Transportation Report.

Mississippi River barge movements have been slowed by freezing since early January, the USDA said. One of the most problematic sections is the St. Louis-to-Cairo stretch of the Lower Mississippi, where freezing and low-water conditions are slowing operations and reducing allowable tow sizes. The 273-mile-long Illinois River stretches from Joliet, Illinois, US, to Grafton, 25 miles northwest of St. Louis, Missouri, US, where it joins the Mississippi River. The Illinois also has seen tow-size restrictions and beginning in the second week of January, locks have required ice coupling, which is a method of connecting barges to one another with freezing water.

High water conditions in the Ohio Valley and snow and ice adjacent to Cincinnati have delayed barge movements on the upper Ohio River.

“Since the second week of January, high spot barge rates have reflected these multiple, widespread logistical challenges,” the USDA said. “The barge industry is operating with extreme caution and preparing for unfavorable weather and water conditions for the rest of January.”

Barged grain movements in the week ended Jan. 15 totaled 491,988 tons, down 10% from the previous week and down 46% from the same period in 2021, according to the US Army Corps of Engineers. In the same week, 297 grain barges moved down river, 53 fewer barges compared with the prior week. There were 830 grain barges unloaded in the New Orleans region, two fewer than the previous week, the Corps and AMS said.

Ocean freight activity

In the week ended Jan. 13, 33 oceangoing grain vessels were loaded in the Gulf, down 23% from the same period in 2021, the AMS said. In the 10 days from Jan. 14, 59 vessels were expected to be loaded, 13% fewer than in the same period of 2021.

The rate for shipping a one tonne of grain from the US Gulf to Japan was $68.50 on Jan. 3, down 3% from the previous week. The rate from the Pacific Northwest to Japan was $37.50 per tonne, down 3% from the previous week.

Trucking activity

The US Department of Transportation, under the auspices of the Federal Motor Carrier Safety Administration, seeks applications for fiscal year 2022 financial assistance for implementing commercial driver’s license (CDL) programs, the AMS said.

“State and local governments and other eligible persons and organizations that support CDL program implementation are encouraged to apply,” the USDA said. “In identifying prospective aid recipients, FMCSA seeks programs that would further its strategic goals for CDL programs. The goals address areas of safety, economic strength and modernization, equity, climate and sustainability, and innovations for the future.”

Fuel prices

The US average diesel fuel price in the week ended Jan. 17 increased 6.8¢ from the previous week to $3.725 per gallon, up 102.9¢ from the same week last year. At $3.603 per gallon, the average Midwest diesel price increased 12.6¢ in the first two weeks of the year.

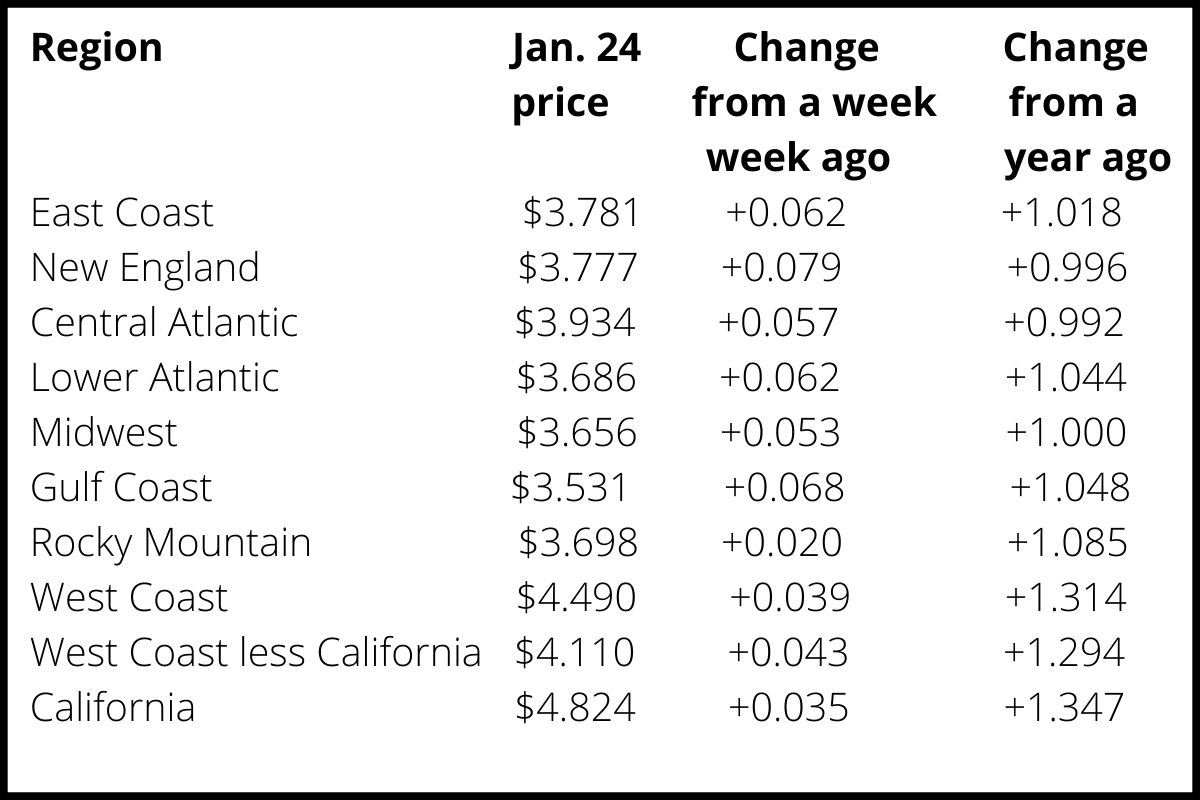

Following are the average weekly on-highway diesel prices per gallon by region on Jan. 24: