Russia has become the world’s leading wheat exporter, but the country has moved to limit the amount shipped abroad in an effort to dampen prices on its home market. The country’s production remains subject to the variations in its harsh winters.

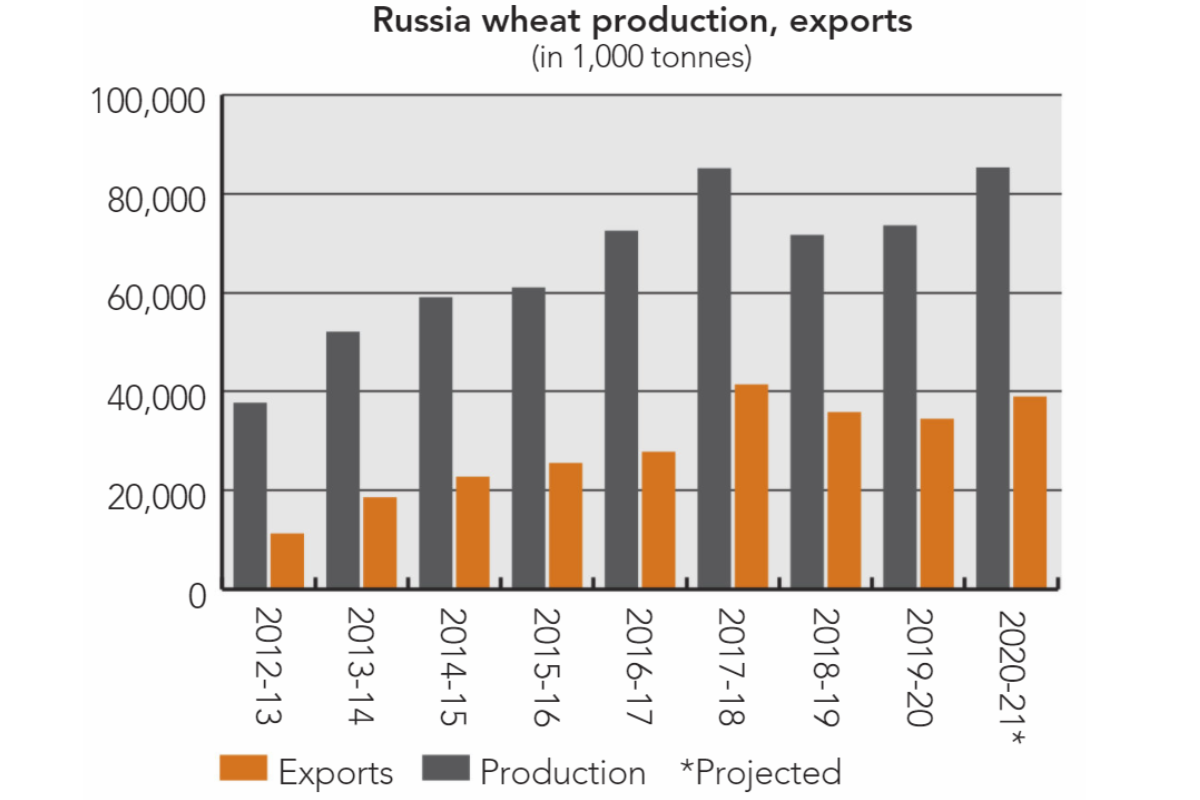

In a Grain Market Report published on Jan. 14, the International Grains Council (IGC) put total Russian grains production in 2020-21 at 125.6 million tonnes, up on its previous estimate of 125.1 million, published on Nov. 26, 2020. It put the previous year’s crop at 114.7 million. Wheat production in 2020-21 was put at 84.5 million tonnes, compared with the previous estimate of 83.5 million and the 2019-20 crop of 73.6 million tonnes.

For 2021-22, the IGC said that “owing to elevated risks of winterkill in southern Russia, all-wheat harvested area is predicted to dip by 1% year-on-year. While recent temperatures have stayed close to average in recent months, precipitation remained mostly light.”

It also noted that because of high local prices for wheat-based products, Russia’s government was reported to be aiming to double production of durum by 2025, including through area gains and improved average yields.

The Economic Research Service (ERS) of the US Department of Agriculture said in its Jan. 14 Wheat Outlook report that Russia’s 2020-21 wheat crop would be a record high 85.3 million tonnes, citing production data from the Russian statistical agency, ROSSTAT.

“Russia’s wheat yields are estimated at 2.98 tonnes per hectare, an 11% increase from the prior year’s yield,” the ERS said.

According to the IGC, the Russian corn crop in 2020-21 is now forecast at 13.5 million tonnes, down from the earlier estimate of 14 million and from the 14.3 million produced in the previous year. The forecast for barley is unchanged at 20.5 million tonnes, up from 19.5 million in 2019-20. Russia’s crop of oats is put at 4.2 million tonnes, another unchanged forecast, with the previous year’s output at 4.4 million. The IGC’s rye production figure is unchanged from its earlier forecast at 1.8 million tonnes, with the previous year at 1.4 million.

The IGC’s forecast for total Russian grain exports in 2020-21 is 47.7 million tonnes, down from an earlier prediction of 48.2 million, but well up on the 2019-20 figure of 42.8 million tonnes. Its 2020-21 grain imports are forecast at 300,000 tonnes, a figure unchanged both from the previous estimate and the previous year’s level.

The country’s wheat exports in 2020-21 are forecast at 38.8 million tonnes, unchanged from the figure published in November, but up on the 34 million attained in 2019-20. Its wheat import forecast is an unamended 300,000 tonnes, up from 200,000 the year before.

Corn exports in 2020-21 are put at 3.6 million tonnes, down from a previous forecast of 4.1 million, with 2019-20 shipments at 4.2 million.

The IGC also expects Russia to export 30,000 tonnes of rye in 2020-21, compared with 3,000 in 2019-20.

Government policy may affect the level of exports.

“In mid-December, Russia announced a further strengthening of planned export controls for the 2020-21 marketing year in efforts to curb domestic price inflation,” the IGC explained. “In addition to the previously announced 17.5-million-tonne cap on grain exports (wheat, corn, barley and rye) from mid-February, an export duty of €25 per tonne is to be applied to wheat shipments, rising to 50% (not less than €100 per tonne) if the quota volume is exceeded.

“Shipments up to the end of December are estimated at around 24 million tonnes, leaving about 14.8 million to be exported in the second half of the season. However, there were rumors that export restrictions could be further tightened.”

There is no annual attaché report on grains for 2020, but in a May 22, 2019, report, the Foreign Agricultural Service said that “Russia has expanded its global market presence with rising exports to Africa, Southeast Asia, and some countries in the Western Hemisphere.”

“Russia has become a major competitor to all other wheat exporting countries,” the FAS said. “One of the key challenges is with respect to infrastructure. There is an acute need to advance the throughput of grain elevators and yet with the current pace of investment, this would take several years. Until then, moving grain internally remains a challenge, especially for various types of rail cars and trains.”

The IGC puts Russia’s 2020-21 soybean production at 4.3 million tonnes, down from a previous estimate of 4.5 million, as well as from the 2019-20 crop of 4.4 million. Its rapeseed crop is put at 2.5 million tonnes, an unchanged estimate, with the previous year’s crop at 2 million. It is expected to export 600,000 tonnes, up from the previous estimate of 500,000, as well as the 500,000 exported in 2019-20.

In an annual report on the sector dated April 27, 2020, the USDA attaché said Russia has a well-developed sunflower seed production and processing sector, and in recent years has increased focus on developing other oilseed production, namely soybeans and rapeseed and minor crops like flax, safflower, and mustard.

“Over the last 15 years, oilseed planted area has increased 2.4 times, reaching 13.8 million hectares in 2018 and 14.5 million hectares in 2019,” the report said. “The important trend of the last four seasons has been the gradual shift from niche crops to more profitable varieties such as sunflower, soybeans and rapeseed. These oilseeds make up 91% of the total oilseeds area in Russia.”

Flour milling

According to data from the Russian Union of Flour Mills and Cereals Plants, published by the European Flour Millers, of which the Russian organization is an associate member, there are 281 industrial flour mills in the country.

Russia produces 9.3 million tonnes of wheat flour and 1.2 million tonnes of rye flour, with mills operating at around 60% capacity.

Biotechnology

In a Feb. 18, 2020, annual report on biotechnology in the country, the USDA attaché said “the Russian Federation does not allow cultivation of GE crops. However, there is no ban on imports of GE commodities, food and feed.”

“In order to import, the Government of Russia (GOR) requires that GE lines present in food, feed and commodities be registered in Russia,” the report explained.

However, Kiev-based agricultural experts UkrAgroConsult reported on Jan 21 that the Russian government extended until Jan. 1, 2022, the exemption of genetically modified (GM) soybeans and meal (soybean oilcake) for animal feed from mandatory state registration, noting that “a draft of a relevant government resolution was published on the federal portal of draft regulatory legal acts.”

“Public opinion in general reflects a negative attitude toward plant biotechnology,” the attaché said. “However, this negative opinion is seldom reflected in purchasing priorities of the Russian population, which are based on the price of products. Moreover, the current economic environment has increased consumer demands for cheaper products, meaning consumers are not necessarily willing to pay extra for non-GE products. GE commodities used for feed do not face the same end-use consumer considerations.”

For the last five years, the Russian government has been actively promoting the idea of producing organic or “environmentally clean” agricultural production, cementing the idea with the Russian public that domestic production is cleaner than some imported products, the report said.

“However, there has not been any regulatory frame for developing organic industry,” the report said.

“Some food processors still prefer purchasing non-GE products, especially soybeans and soybean products. However, price is the main concern now for both food processors and consumers,” the report said.