OTTAWA, CANADA — Canada mandates it will not exempt grain dryers to from its carbon tax.

Citing internal department data, Agriculture Minister Marie-Claude Bibeau said the carbon tax would cost an individual farm between C$210 to C$819 per year, said the National Post. Yet many Canadian farmers say they are paying more than the government’s estimate.

The carbon tax is not applied to fuels used in farm vehicles and only partially applied to fuels used to heat commercial greenhouses. The carbon tax exemption does not apply to the propane and natural gas used in grain dryers.

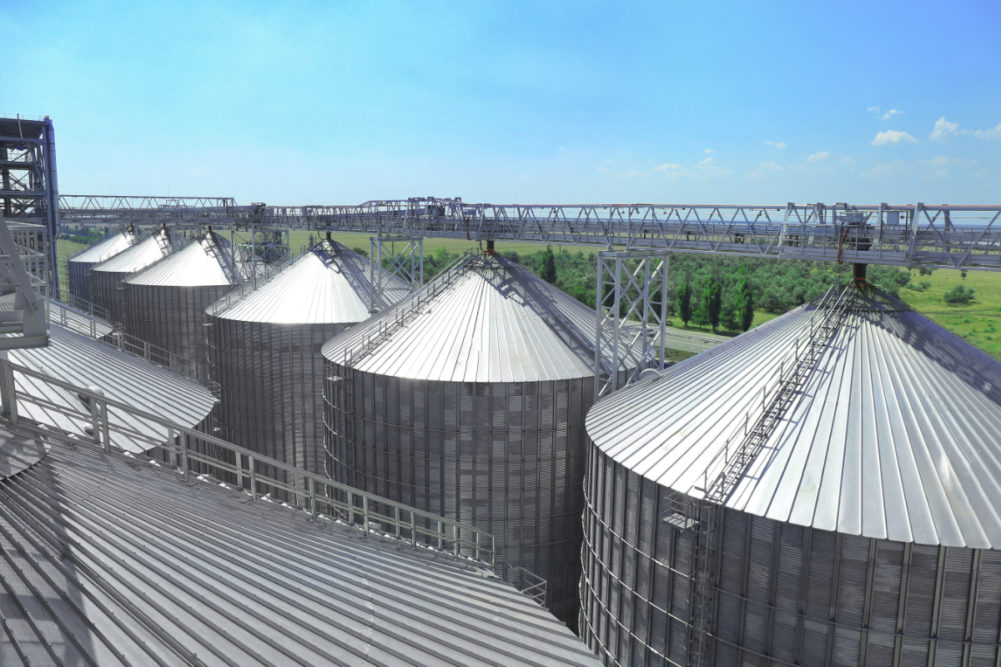

Grain dyers are used to help dry wet grains so they can be properly stored. The National Post noted Canada had a particularly wet fall creating a need to use grain dryers.

Todd Lewis, president of the Agricultural Producers of Saskatchewan (APAS), told the National Post that “grain dryers were running for a record amount of time” during the past winter and farmers paid more than the federal government carbon tax estimate.

According to a financial review by APAS, Saskatchewan farmers can expect to lose 8% of their total net income in 2020 to the carbon tax. For a household managing a 5,000-acre grain farm in Saskatchewan, this will take the form of a C$8,000 to C$10,000 bill.

The review also noted income loss will rise with the expected tax increase in 2022. When the carbon tax increases to C$50/tonne in 2022, this bill will go up to C$13,000 to C$17,000 for the same household — the equivalent of a 12% decrease in net income.

The APAS review included the consideration of all major farm expenses not currently exempt from the carbon tax. These include grain drying, rail transportation, heating and electricity, and truck hauling of crops off the farm.