WEST LAFAYETTE, INDIANA, U.S. — With the prospect of improved trade with China, U.S. agriculture producers’ sentiment increased sharply in January on the Purdue University/CME Group Ag Economy Barometer.

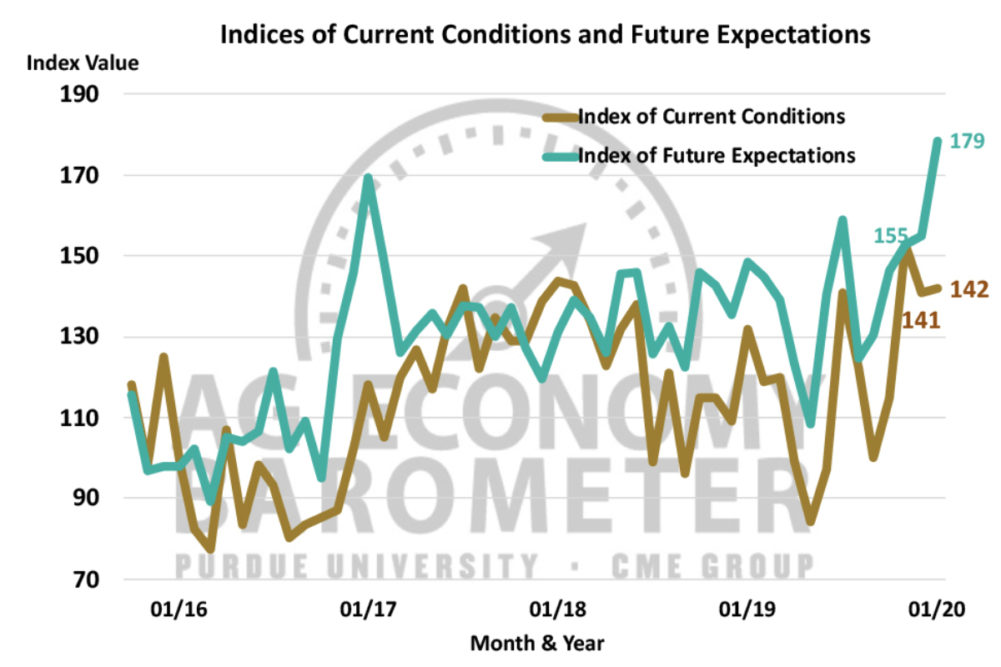

The barometer rose 17 points from December to 167 while the Index of Future Expectations increased 24 points to a reading of 179. The Ag Economy Barometer is based on a mid-month survey of 400 U.S. agricultural producers and was conducted from Jan. 13-17.

The sentiment improvement took place as the phase one trade agreement between the United States and China was being discussed and signed in mid-January.

“The phase one trade agreement has largely been considered a win for U.S. exporters, although few details are available regarding how the additional $200 billion in purchases by China will be distributed over the next two years and how much impact it will have on the U.S. farm sector,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

One topic that was not directly addressed in the phase one agreement was the soybean trade dispute. Despite that, producers remain optimistic about the dispute’s resolution. In January, 69% of those surveyed felt that the soybean trade dispute would be settled soon, up from 54% in December, and 80% felt that the outcome will be favorable to U.S. agriculture, up from 72% in December.

Expectations for an increase in U.S. agricultural exports over the next five years also has steadily improved.

As recent as October 2019, only 55% of producers expected agricultural exports to increase; however, starting in November 2019 and continuing through January 2020, about 70% of those surveyed expect to see an increase in U.S. agricultural exports in the next five years.

Producers are asked each winter about the rate of growth they expect for their operations over the next five years. Since the question was first posed in 2015, there has been a small percentage that plan to grow rapidly and a large group that had no plans to grow or plans to exit/retire.

However, those who indicated they have no growth plans and/or expect to exit/retire has been rising steadily since 2018. For example, in January 2020, a combined 56% of farmers said that they have no plans to grow or plan to exit/retire, up from 50% in 2019, and up from 39% in 2018.

“The tremendous volatility the ag sector has experienced the last couple of years could be interpreted as a signal to producers to be more cautious regarding future expansion plans,” Mintert said.