The European rapeseed market was supported as harvesting got underway in France by the expectation that the main producing countries are set to see a reduced crop. Reduced area and weather problems mean that output forecasts for soybeans in the United States also have been cut.

In its Oil Crops Outlook report, published July 15, the Economic Research Service of the U.S. Department of Agriculture raised its forecast for world soybean exports in 2019-20 to 151.3 million tonnes, up 209,000 tonnes on its estimate from a month earlier and from 150.2 million in 2018-19.

“Lower prospects for U.S. trade in 2019-20 are seen being more than offset by gains for Brazil, Argentina, and Uruguay,” the ERS said.

The ERS explained that U.S. soybean area is at a six-year low. In the July World Agricultural Supply and Demand Estimates report, the USDA cut its forecast for 2019-20 U.S. soybean output to 104.64 million tonnes, down from the month earlier projection of 112.95 million, as well as from the previous year’s crop of 123.66 million tonnes.

The ERS said Brazil’s exports may be boosted to 76 million tonnes by a higher carryover in October, after a downward revision in 2018-19 exports, to 77.3 million tonnes. The ERS said that the firm pace of shipments may get Argentina’s exports to 8 million tonnes, given the firm pace of shipments. In 2018-19, Argentina exported 8.75 million tonnes.

“Lately, more soybeans have become available for Argentine exports due to a less robust domestic crush market,” the ERS said.

The USDA has cut its forecast for 2019-20 world rapeseed production by 3 million tonnes, to 71.8 million tonnes.

“The main reductions are divided between the European Union, Canada and Australia,” the ERS said. “Crop losses for these countries could pull down global ending stocks to a three-year low. A decline for E.U. rapeseed production in 2019-20 was already anticipated based on a sharp reduction in sown area, Last fall, very dry conditions for planting pulled down rapeseed area by 19% to 5.75 million hectares.

“Soil moisture had improved throughout Europe by early 2019. In June, however, the weather turned brutally hot and dry during a key period for rapeseed flowering and seed filling.”

Because of lower-than-expected yields for Germany and France, the ERS cut its forecast for E.U. rapeseed production by 1 million tonnes, to 18.7 million.

The ERS quoted Canadian official data showing canola plantings down, with the area cut by 400,000 hectares, to 8.4 million.

“Farmers likely reacted to falling prices brought on by a disruption of export shipments to China,” the ERS said. “The dry conditions that prevailed in the Canadian prairies earlier this spring have since been eased by better rainfall throughout June.”

Because of the reduced area, the USDA has cut its forecast for 2019-20 canola production in Canada by 1 million tonnes, to 20.1 million.

Australia’s canola production in 2019-20 is expected to recover by 19% after the previous year’s drought. However, a weaker recovery is now likely with a crop reduction of 1.1 million tonnes this month to 2.6 million, the ERS said

“Australian new-crop exports of canola are forecast down 400,000 tonnes to 1.9 million, matching the 2018-19 level,” the agency said. “A steep decline is also expected for Australian season-ending canola stocks.”

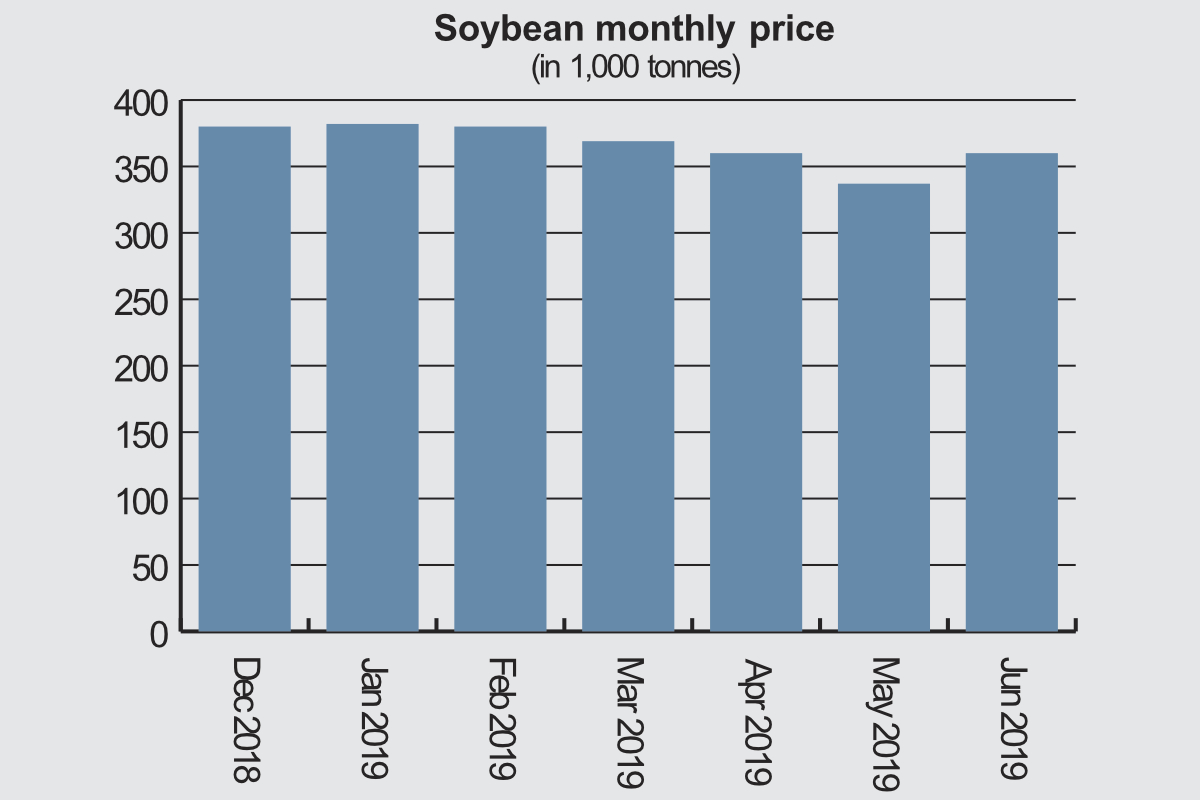

The International Grains Council (IGC) reported in its Grain Market report at the end of May that with gains in the United States and Brazil more than offsetting a decline in Argentina, its price index for soybeans had risen by 1% on the month.

“Chicago futures recorded gains of 3% on deepening worries about the impact of excessive wetness on U.S. crop prospects,” the IGC said. “With strength in maize adding support, this more than offset pressure from export demand concerns as hopes for a resolution to the ongoing trade dispute with China remained faint.”